The euro, British pound and the yen are seen trading range bound in the near term, awaiting the next major fundamental catalysts, but could see a temporary retracement to the current direction.

Gold prices have established support at 1327.50 and could be seen trading within 1350 – 1327.50 range but the downside to test 1300 remains in play.

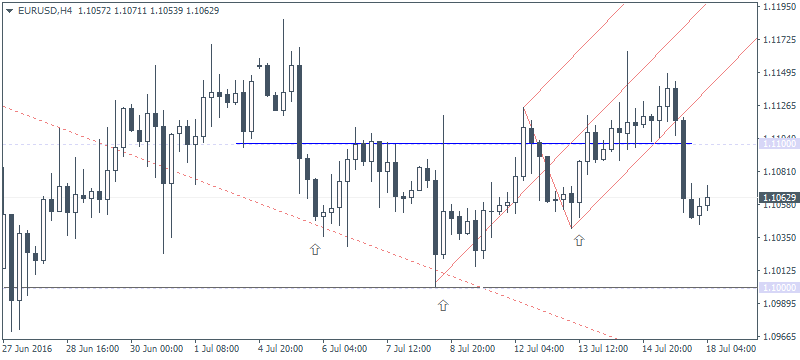

EUR/USD Daily Analysis

EUR/USD (1.106) closed below 1.110 on Friday with a bearish momentum. Price action is unlikely to change much from here with EUR/USD seen trading within 1.110 and 1.10 price levels.

On the 4-hour chart, following the breakdown below 1.110, any retracements are likely to stall near 1.110 to establish resistance. To the downside, 1.10 remains in focus while a breakout above 1.110 could potentially keep EUR/USD supported for a test to 1.120.

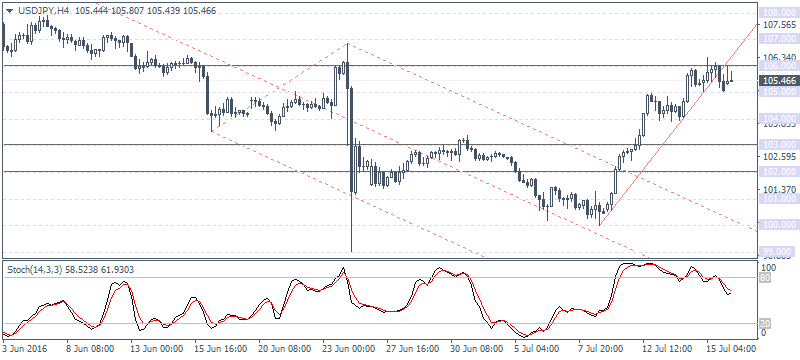

USD/JPY Daily Analysis

USD/JPY (105.46) briefly tested 106 resistance before closing bearish. Price action remains constrained for the moment but the bearish outlook remains in place following the breakout of the minor rising trend line.

A close below 105 could signal a correction towards 103 - 102 support, which will mark the downside correction for an eventual move back to 106. To the upside, a close above 106 and continuing with the current bullish momentum could send USD/JPY to extend its gains to 107 - 108 resistance.

GBP/USD Daily Analysis

GBP/USD (1.321) closed back near 1.32 on Friday which could hold out as support in the near term. Having tested the resistance zone near 1.34 - 1.48, GBP/USD could stay range bound within these levels.

An upside breakout could see GBP/USD test 1.36 and eventually fill the gap near 1.36770. To the downside a breakout below 1.32 could see further declines down to 1.30.

Gold Daily Analysis

XAU/USD (1329.05): Gold prices are seen retreating lower but price action has been trading within the range from last Thursday's high and low. Expecting a breakout off the current levels, gold prices could be seen rising back to 1350 to establish resistance ahead of a longer term correction to 1300.

On the 4-hour chart, 1327.50 has been seen as establishing support which could keep the bullish view in play. A breakout below 1327.50 could see gold prices slide to 1310.50 to test the next lower support.