U.S. inflation under the magnifying glass

There’s little news to report this morning, with crude oil hovering close to its recent high as markets expect further declines in inventories. With an increase in global demand and diminished Canadian and Nigerian output, there are a number of signs pointing in the same direction. Surprisingly on the currency front, oil’s performance yesterday only resulted in limited gains for the usual suspects, including the loonie.

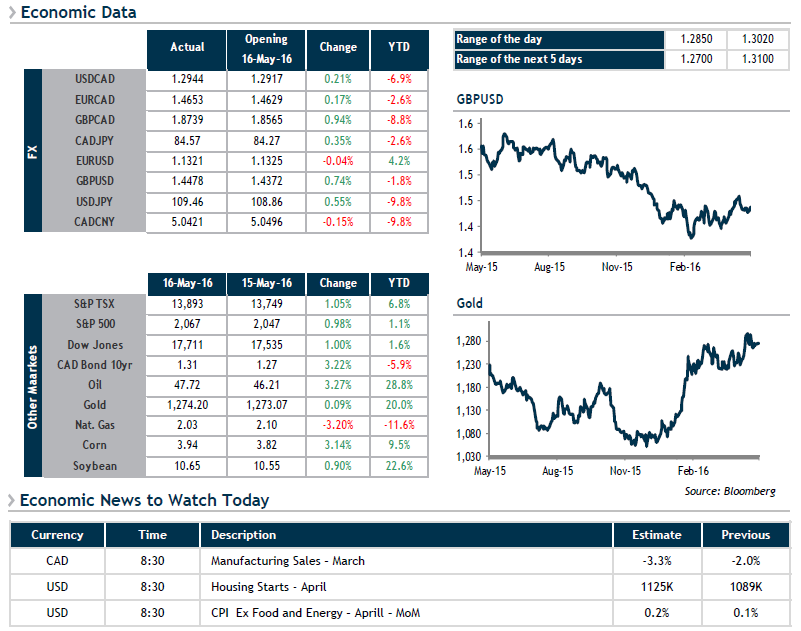

In fact this morning, petroleum-correlated currencies have already given up their meagre gains from the previous day, possibly due to the media circus regarding potential new key rate increases from the Federal Reserve. The pound sterling is the only standout performer, having risen after survey results were announced showing that most UK citizens want to remain in the European Union. With the June 23 Brexit vote approaching, it’s likely that the GBP will have further opportunities to react.

South of the 49th parallel, at 8:30 we’ll get a glimpse at the health of the real estate sector and more importantly where inflation stands. Keep in mind that increasing inflationary pressure would add to the likelihood of monetary tightening and by extension, favour the greenback.