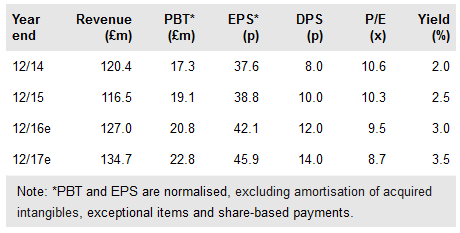

Stv Group (LON:STVG) is on track for a good first half with growth across the board, particularly in digital and production. On a 9.5x FY16e P/E with dividend support, the share offers good value. Furthermore, the valuation of the defined pension deficits will conclude in this quarter, which should clarify STV’s cash commitments for the next three years and may pave the way for special dividends further out.

Trading in line; prisons recommissioned

STV has reported a good start to the year with Q2 continuing in much the same vein as Q1. Management expects total airtime sales in the first half to be up 2% y-o-y with a strong regional performance up 23%, offsetting a flattish national performance, -1%. Digital revenues, up 25% in Q1, are expected to continue at this rate for the year ahead and production, after a difficult 2015, has had a very good start to 2016. Production has a strong pipeline – revenues secured for the year are already higher than those delivered during 2015 – in parallel, STV has announced the recommissioning by Sky of a second eight-part series of Prison: First & Last 24 hours.

To read the entire report Please click on the pdf File Below