The article aims to provide forecasts for commodity prices (World Bank’s Pink Sheets) for April 2016. The Pink Sheet is a monthly statistical report on prices of major agricultural commodities, metals and minerals, energy and fertilizers (1960-2016). Monthly prices for the series are published at the beginning of each month. The prices are positively correlated with the futures prices (e.g. correlation ratio for gold over 1990:4-2016:3 – 0.998; for silver over 2003:3-2016:3 – 0.991; for crude oil WTI over 1990:4-2016:3 – 0.997; for crude oil Brent over 2003:4-2016:3 – 0.994).

The previous forecasts performed very well: the average mean absolute error expressed in percentages was 4.39. Because of both high positive correlation and accuracy of forecasted values, it could be recommended to check the values provided in this article. They can be used for identifying price trends for some exchange-traded commodities.

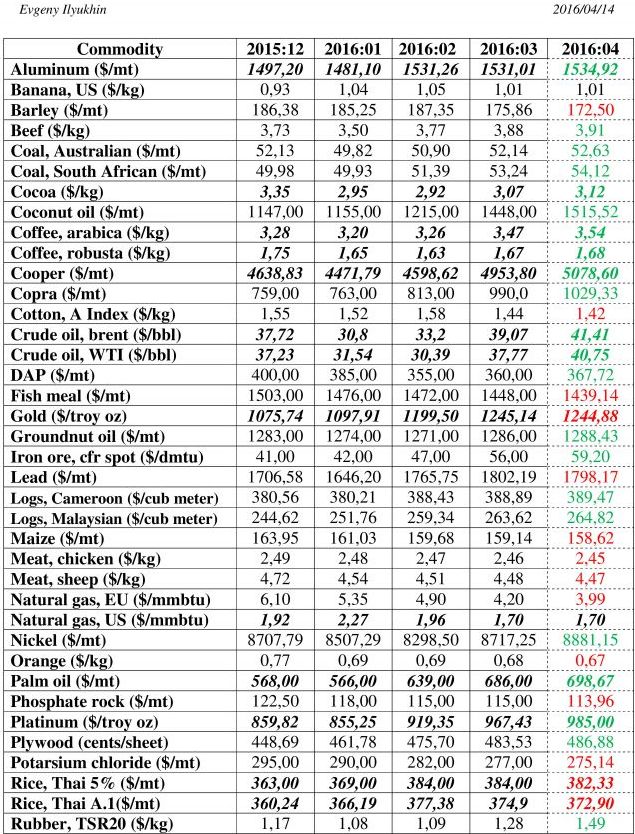

The monthly commodity prices in nominal US dollars over the period from December 2015 - March 2016 (World Bank’s Pink Sheets) and forecasted period (Author’s Calculations) for April 2016 are presented in tables below. The Pink Sheets for April 2016 will be released on May 4, 2016. Forecasts are projected with an Autoregressive Integrated Moving Average (ARIMA) model based on monthly historical data (January 1960 – March 2016). Commodities are placed in alphabetical order.

Forecasted values: increase in green; decrease in red. The following commodities with exchange-traded contracts can significantly rise: Coffee (6.44%), crude oil Brent (5.99%), crude oil WTI (7.89%). One can expect the modest increases for Copper, platinum, zinc (1.5-2.0%). The notable decreases are not expected.