NZD/USD has posted slight losses on Tuesday, continuing the downward trend which started off the trading week. Early in the North American session, the pair is trading at 0.6770. On the release front, the US trade deficit widened to $47.1 billion, higher than expected. Later, the US releases ISM Non-Manufacturing PMI and JOLTS Job Openings. In New Zealand, NZIER Business Confidence slipped to 2 points in the fourth quarter. ANZ Commodity Prices declined 1.3%. The markets are keeping an eye on the New Zealand GDT Dairy Auction, a key event.

New Zealand’s resource-based economy is heavily dependent on its export sector. Weak global demand, highlighted by the Chinese slowdown, has been bad news for the island economy, which conducts 20 percent of its trade with the Asian giant. ANZ Commodity Prices declined 1.3% in March, marking its fourth decline in five months. There was no relief from NZIER Business Confidence, which slid to 2 points in the fourth quarter, compared to 15 points in the previous release. This points to a sharp drop in optimism in economy on the part the business sector.

Last week’s US employment indicators point to a solid US labor market. Nonfarm Payrolls came in at 215 thousand, above the estimate of 205 thousand. The unemployment rate edged up to 5.0%. However, wage growth remains weak, as Average Hourly Earnings posted a small gain of 0.3%, close to the estimate of 0.2%. The markets will be treated to more employment data on Tuesday, with the release of JOLTS Jobs Openings. The estimate for February stands at 5.57 million, which would be an improvement from the previous month’s reading of 5.54 million. Solid job numbers are critical to continued economic expansion and are a key factor in the Fed’s decision-making process regarding another rate hike.

Janet Yellen single-handedly sent the US dollar flying on its backside last week, thanks to a surprisingly dovish speech in New York. Yellen warned of risks to the US economy from uncertainty in the global markets and the slowdown in China, and poured cold water on speculation of an April rate hike. Prior to her speech, several Fed members issued hawkish comments, some going as far as calling for a rate hike at the April policy meeting. The contradictory messages coming out of Fed points to a split in the FOMC concerning monetary policy, although Yellen is likely to have the last word. Mixed messages out of the Fed creates uncertainty that the markets could do without, so analysts will be paying close attention to the Fed minutes on Wednesday, looking for clues as to further rate projections. Traders should be prepared for some volatility after the release of the minutes.

Monday (April 4)

- 9:00 New Zealand ANZ Commodity Prices. Actual -1.3%

Tuesday (April 5)

- 8:30 US Trade Balance. Estimate -46.3B. Actual -47.1B

- 9:45 US Final Services PMI. Estimate 51.0

- 10:00 US ISM Non-Manufacturing PMI. Estimate 54.1

- 10:00 US JOLTS Jobs Openings. Estimate 5.57M

- 10:00 US IBD/TIPP Economic Optimism. Estimate 47.7

- Tentative – New Zealand GDT Price Index

Upcoming Key Events

Wednesday (April 6)

- 14:00 FOMC Meeting Minutes

*Key releases are highlighted in bold

*All release times are DST

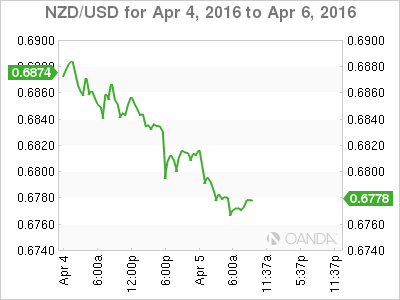

NZD/USD for Tuesday, April 5, 2016

NZD/USD April 5 at 9:00 DST

Open: 0.6807 Low: 0.6760 High: 0.6821 Close: 0.6773

NZD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6449 | 0.6605 | 0.6738 | 0.6897 | 0.7011 | 0.7100 |

- NZD/USD showed limited movement in the Asian session. The pair posted slight losses in European trade and is steady in North American session.

- 0.6897 has strengthened in resistance as NZD/USD continues to lose ground

- 0.6738 is providing support. It is a weak line

Further levels in both directions:

- Below: 0.6738, 0.6605 and 0.6449

- Above: 0.6897, 0.7011, 0.7100 and 0.7231

- Current Range: 0.6738 to 0.6897

OANDA’s Open Positions Ratio

The NZD/USD ratio is unchanged on Tuesday. Long positions have a majority (55%), which is indicative of trader bias towards NZD/USD reversing directions and moving to higher ground.