- Eurozone retail spending is set to rise for fourth straight month in February

- A firmer growth trend is expected for the March ISM Non-Manufacturing Index

- Will US job openings continue to increase in today’s February estimate?

Tuesday’s a busy day for economic news on both sides of the Atlantic, including today’s monthly report on retail spending for the Eurozone. Later, two US updates will be closely read as the crowd looks for new guidance in the wake of mixed economic reportsin recent days.

Eurozone: Retail Sales (0900 GMT) The outlook for first quarter GDP growth in the euro area continues to hold at a 0.4% rate, according to Now-casting.com’s weekly update. The firm’s latest forecast (published on April 1) ticked down for the second time in as many weeks, but only fractionally. The current outlook is still a slow pace, but the estimate still points to a slight improvement over last year’s 0.3% rise in Q4.

Forecasts can be wrong, of course, but today’s monthly update on retail spending for Europe in February will provide an important hard data clue for deciding if Now-casting.com’s upbeat projections have merit.

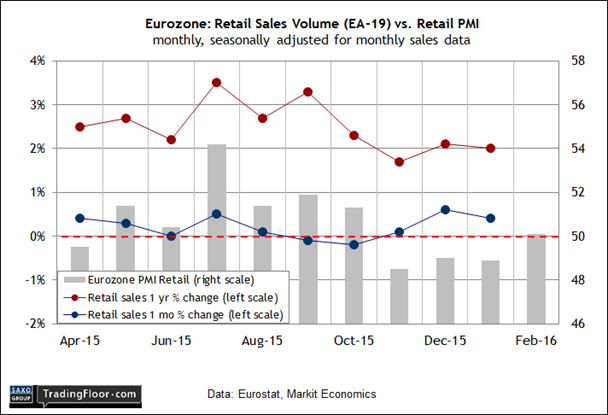

Meantime, last month’s sentiment data for the retail sector offered a degree of hope, albeit by a hair. Markit’s PMI for Eurozone retail in February moved back into positive territory (just barely) for the first time in three months. Unfortunately, Germany was still the main source of support.

Nonetheless, economists think that today’s hard numbers on consumer spending in February will post another gain. Econoday.com’s consensus forecast sees retail sales edging up by 0.1% for the monthly comparison.

That's a weak gain relative to previous numbers. On the other hand, another rise will reflect the fourth straight increase and offer a reason to embrace the relatively firm estimate for Q1 GDP growth.

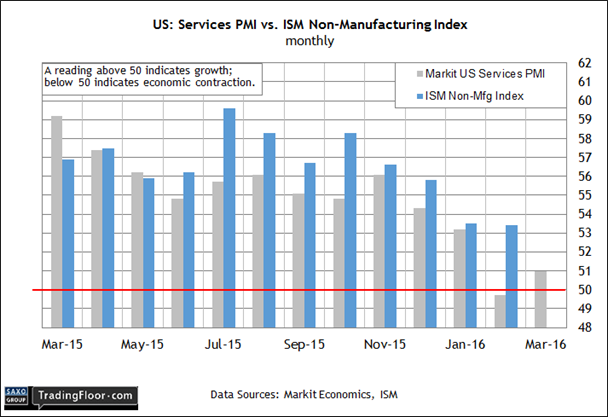

US: ISM Non-Manufacturing Index (1400 GMT) The services sector has been weathering a persistent deceleration in growth since last year’s fourth quarter, but the preliminary data for March suggests that a degree of stabilisation and revival have arrived.

For the first time in four months, Markit’s Services PMI posted a higher reading in the flash report. After slumping into negative territory in February (below the neutral 50.0 mark), the index posted a modest gain and settled at 51.0.

That’s still a weak reading, raising questions about the near-term outlook for the services sector. In fact, Markit’s chief economist late last month outlined a worrisome profile. “The greatest concern is the near-stalling of new business growth,” said Chris Williamson. “Demand for goods and services is growing at the slowest rate seen this side of the global financial crisis.”

Today’s first look at the ISM Non-Manufacturing Index for March, however, is on track to deliver better news. Econoday.com’s consensus prediction calls for a respectable gain in this benchmark to 54.0. In that case, this reading of services activity for March will rise to the highest level since last December.

Note that the ISM data for services has remained in growth territory all along, in contrast with the PMI numbers. Slow growth generally is still an issue - for services and the US economy overall. The Atlanta Fed’s GDPNow model last week projected that first quarter GDP growth will be a sluggish 0.7%. But the case for expecting a modestly stronger trend in services will receive fresh support if today’s ISM report matches expectations.

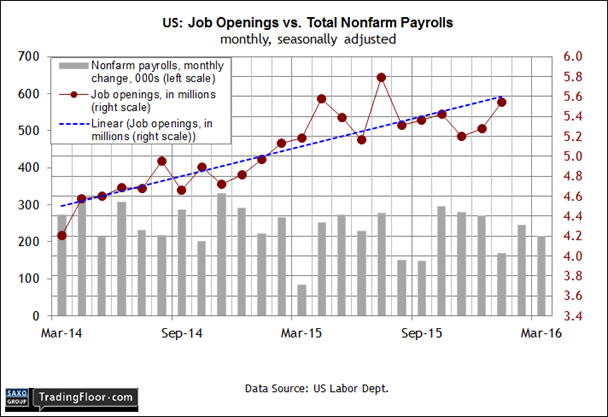

US: Job Openings and Labor Turnover Survey (1400 GMT) Last week’s March report on payrolls continued to post solid growth in the labour market. Today’s estimate of job openings will provide deeper context for deciding if the positive momentum will roll on in the spring.

Recent history looks encouraging from the perspective of new positions offered. The linear trend in job openings is currently posting a solid up-trend, as shown in the dashed blue line in the chart below. Meantime, nonfarm payrolls have posted healthy gains for the most part in recent months – a gain that job openings data appeared to anticipate.

In the previous update, the number of openings rose to 5.541 million in January – a six-month high. In other words, the demand for workers appears to be firming, which inspires some analysts to forecast a healthy rise in payrolls going forward.

Note, however, that two updates of multi-factor indexes suggest that the labour market may be weaker than recent updates suggest. The March releases of the Conference Board’s Employment Trend Index and the Federal Reserve’s Labor Market Conditions Index reflected a softer trend last month.

“The Employment Trends Index has been showing signs of weakening in recent months, suggesting that employment growth is likely to slow through the summer,”

noted a Conference Board economist yesterday.

“With GDP barely growing at a two percent rate, it’s difficult to see how employment can continue to expand by 200,000 or more jobs per month.”

Doubts about the labour market's outlook are still a speculative affair. Yet questions about where we go from here will move to the fore if we see a weak report in today’s update on job openings.

Disclosure: Originally published at Saxo Bank TradingFloor.com