Oil (NYSEARCA:USO) climbed to $103/bbl. as economic pressure from Europe and the United States continued to build on Iran.

ETFs in the energy arena (NYSEARCA:OIL) (NYSEARCA:USL) reflected escalating tensions in the Persian Gulf with the oil complex adding approximately 4% in the last two sessions. Further upward price pressure came from today’s report from the American Petroleum Institute (API) which indicated that for the week ended December 30th, inventories declined 4.4 million barrels.

The European Union upped pressure on Iran as the Union agreed to an embargo of oil purchases from Iran, which, along with financial actions in the United States, will serve to cripple Iran’s oil dependent economy before an upcoming national election.

Iran is the world’s third largest exporter of oil and 60% of its economy is oil based. The European region is the second largest consumer of Iranian oil after China and so this embargo could have some real impact on Tehran and its nuclear ambitions. Europe is largely dependent on oil imports and major European ETFs declined sharply on the news of escalating tensions with Vanguard’s European Vipers Fund (NYSEARCA:VGK) dropping 1.2% and iShares Europe 350 (NYSEARCA:IEV) shedding 1.03%.

At home U.S. stocks were quiet with major indexes near flat line and gold advancing +0.77%.

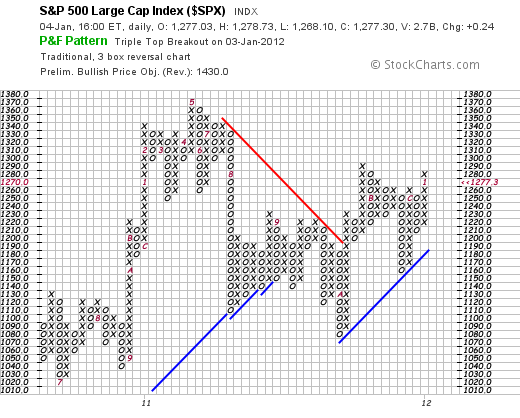

Yesterday’s rally strengthened the technical picture with the S&P 500 moving solidly above the widely watched 200 day moving average and registering a “Triple Top Breakout” in point and figure charting methodology.

In the chart above, we can see how the breakout formed yesterday and the index is solidly above the blue bullish support line. The Price Objective is now 1430 and next (and last) significant resistance is at 1290 which corresponds to significant highs in August and November. A breakout here would open the door to further price rises towards the 1340 level.

Today brings the ADP Employment report along with weekly jobs claims and ISM Non Manufacturing reports, all leading to Friday’s grand finale with the Non Farm Payrolls and Unemployment reports.

Disclaimer: Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time. Wall Street Sector Selector has long positions in USO.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil Climbs, Europe Back In Focus

Published 01/05/2012, 03:39 AM

Updated 05/14/2017, 06:45 AM

Oil Climbs, Europe Back In Focus

Oil climbs to eight month high as Europe moves to up pressure on Iran

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.