Technical Major Currencies

EUR/USD

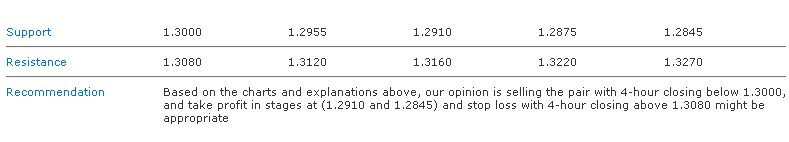

As we mentioned before, consolidation below 1.3270 and 1.3220 is negative and could trigger a downside movement, and this is what happened indeed, as we can see the pair confirmed the descending channel which could trigger more bearishness. But, the pair is facing the psychological level of 1.3000, where a breach of this level is required to confirm the resumption of the downside movement, especially when momentum indicators are excessively oversold. Therefore, we expect the downside movement to extend today, but 4-hour closing below 1.3000 is required to confirm our outlook.

The trading range for today is among the major support at 1.2790 and the major resistance at 1.3270.

The short-term trend is to the upside with steady daily closing above 1.2795 targeting 1.5135.

GBP/USD

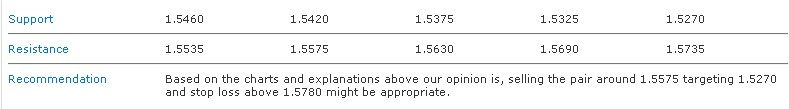

The pair dropped sharply yesterday to breach the important support level at 1.5575-1.5600. As shown on the chart above; the pair has been trading within a main descending channel where the 50-days SMA (colored in green) formed a ceiling for the latest bullish correction, currently Stochastic crossed over negatively and pointing downwards. Accordingly, we expect the bearishness to continue however we may see a slight pullback to test areas around the breached support at 1.5575 which should limit near term upside attempts.

The trading range for today is among key support at 1.5350 and key resistance at 1.5780.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of1.6875 areas remain intact.

USD/JPY

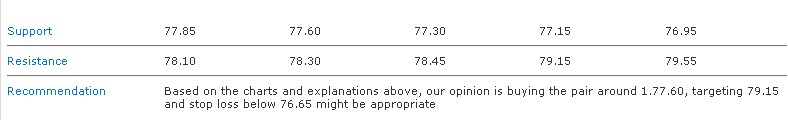

As shown above on the chart, we see that the pair was able to settle above the descending resistance level and also above 23.6% Fibonacci correction of the bullish wave, which started at 76.65 and ended at the top of 78.28, where this correction stands at 77.85 and could be the first support level that could help momentum indicators to get rid of the negativity. Downside corrections are possible and could lead the pair to test the mentioned level, or to extend the correction further to test 61.8% Fibonacci correction around 77.60; but in general, we expect the pair to extend the upside move after relieving momentum indicators from negativity.

The trading range for today is among the major support at 76.55 and the major resistance at 79.15.

The short-term trend is to the upside as far as 75.20 remains intact targeting 87.45.

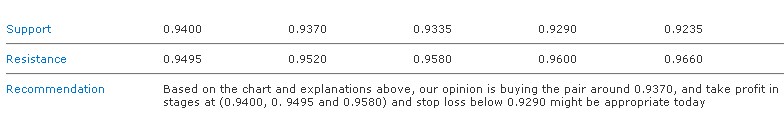

USD/CHF

Stability above 0.9400 negated our expectations related to the Butterfly pattern, and now we observe the weekly chart to recognize the previously mentioned Deep Crab pattern. Consolidation above 0.9400, which represents 50.0% Fibonacci correction of the Deep Crab pattern, suggests an upside move today towards the pattern’s second target, which represents 61.8% Fibonacci correction at 0.9950. Downside corrections are possible, but consolidation above 0.9235 should support our expectations to remain valid, while stability above 0.9370 supports our outlook significantly.

The trading range for today is among the major support at 0.9235 and the major resistance at 0.9660.

The short-term trend is to the upside with steady weekly closing above 0.8020 targeting 0.9400.

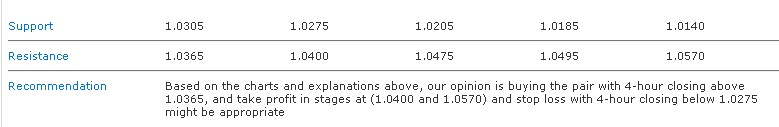

USD/CAD

The upside move continued, affected by consolidation above 50% Fibonacci correction at 1.0275, and now the pair is trading around 61.8% Fibonacci correction at 1.0365. Stochastic is within overbought areas, yet the indicator doesn’t provide any reversal signs, while the RSI is stable above the 50-point level. Therefore, 4-hour closing above 1.0365 suggests the extension of the upside move, where the mentioned closing is required to negate any attempt from Stochastic to provide a negative crossover.

The trading range for today is among the major support at 1.0205 and the major resistance at 1.0570.

The short-term trend is to the downside as far as 1.0665 remains intact targeting 0.9000.

Technical Cross Currencies

GBP/JPY

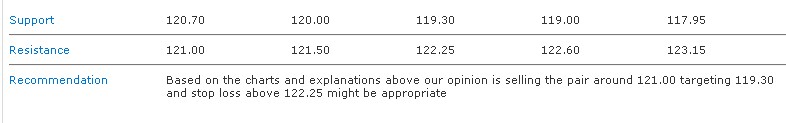

The pair breached the sideways range support at 121.00 and yesterday’s closing was below those areas. This move activates the intraday bearishness expected for today supported by the negative pressure from MA 50; targets start at 119.30 and breaching this level will accelerate the downside move towards 116.80.

The trading range for today is expected among the key support at 117.95 and the key resistance at 122.25.

The short term trend is to the downside as far as 150.00 remains intact with targets at 112.00.

EUR/JPY

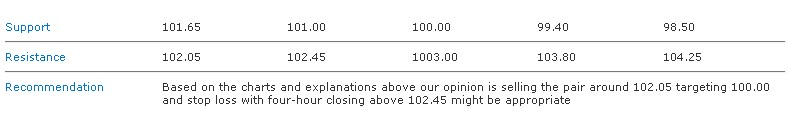

The pair acquired the full target of the bearish formation previously completed with the breach of the support shown in red above. This led the pair to trade below the support for the minor descending channel that organized trading from the top of the mentioned pattern. Therefore, we expect the pair to resume the intraday bearishness today yet will be preceded by a retest to the breached support that turned into resistance at 102.05 where a breach of which will delay the bearish targets that start from 100.00 areas.

The trading range for today is expected among the key support at 100.00 and the key resistance at 102.45.

The short term trend is to the downside as far as 123.30 remains intact with targets at 94.80.

EUR/GBP

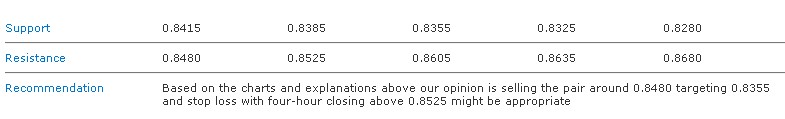

The pair resumed the downside move yesterday reaching 0.8400 areas where it found good support to temporarily end the bearishness. In general, the breach of 0.8225 in addition to the downside pressure from the MA 50 support our expectations for an intraday downside move today while the positivity on Stochastic might cause some volatility and a slightly upside correctional bias.

The trading range for today is expected among the key support at 0.8325 and the key resistance at 0.8480.

The short term trend is to the upside as far as 0.8480 remains intact with targets at 1.0370.