Caterpillar

Industrials - Machinery | Reports January 28, Before Market Opens

Key Takeaways

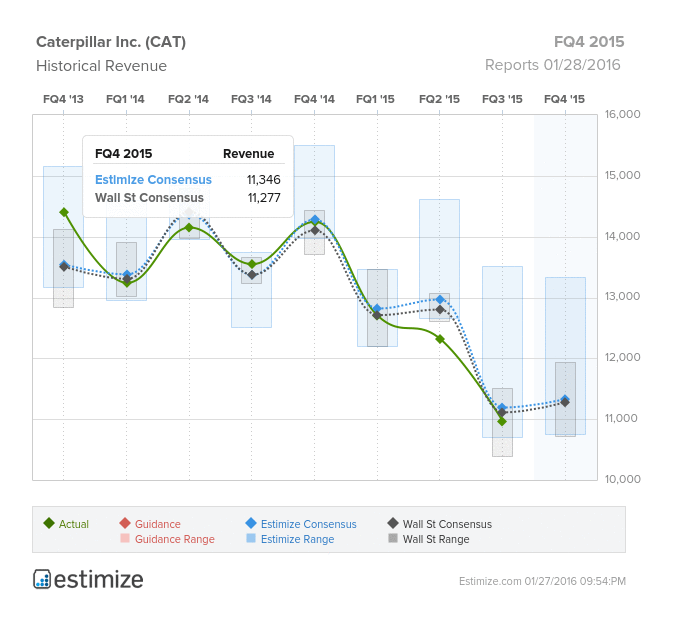

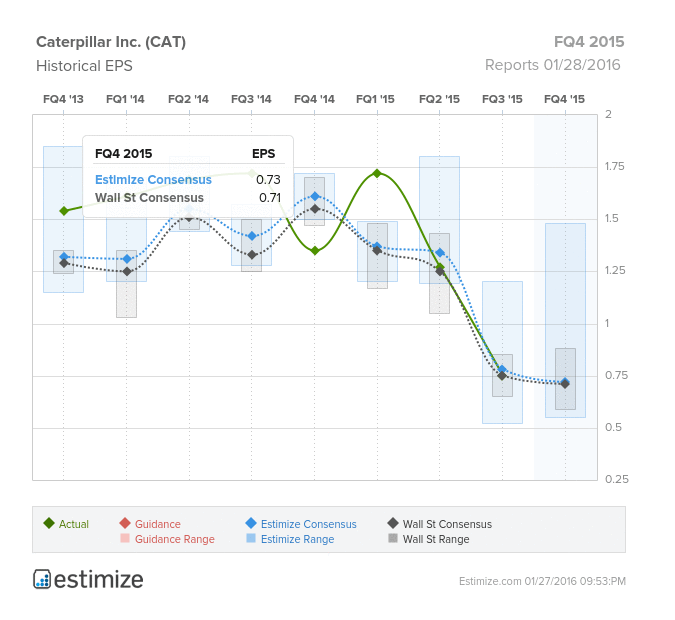

- The Estimize community's call on Caterpillar (N:CAT) is for EPS of $0.73 and revenue of $11.346 billion, slightly higher the Wall Street consensus

- Caterpillar is expected to underwhelm in 2016 as slumping commodities market, slowing demand in China and currency headwinds persist

- To deal with the recent turmoil, Caterpillar is undergoing significant cost cutting initiatives

Today, Thursday, January 28th, Caterpillar is scheduled to report Q4 2015 earnings before the markets open. The manufacturer is poised to continue its free fall with a third straight quarter of negative growth.

Caterpillar is a prime example of how tough it can be to grow during a cyclical downturn. On the heels of their last earnings report, Goldman Sachs downgraded the stock to a sell under the expectation that a new commodity deflation cycle will cripple Caterpillar. This quarter, the Estimize community calls for EPS of $0.73 and revenue of $11.346 billion, slightly higher the Wall Street consensus. Compared to Q4 2014, this represents a projected YoY contraction in EPS and revenue of 45% and 19% , respectively.

Unfortunately, Caterpillar is expected to underwhelm in 2016 as slumping commodities market, slowing demand in China and currency headwinds persist.

Caterpillar continues to falter from a severe downturn late in the business cycle, which saw share prices fall 36% since the start of 2015. As a leading manufacturer of construction and mining equipment, Caterpillar’s key business crumbles when the commodities market drops.

Since oil has dropped below $30 per barrel, sales of industry related equipment have declined. Even at much higher prices, oil and gas exploration would cut back on drilling activity. Moreover, prices of precious and industrial metals have slipped lately, delaying any hope for recovery.

Along with commodities, Caterpillar faces challenges as economic turmoil in China and other emerging markets persists. A pullback in higher growth markets could hurt Caterpillar’s key business even further. On top of this, currency headwinds from a strong U.S. dollar have weighed down company revenues.

To deal with the recent turmoil, Caterpillar is undergoing significant restructuring and cost cutting initiatives which, in the short term, will put pressure on margins. Unfortunately, Caterpillar should continue its downward spiral until the state of oil, commodities and the global economy picks up.