Tom Cloud provided an update on the precious metals market today. He begins discussing a meeting he had with one of the largest precious metals wholesalers in the country and world. One of the topics discussed during that meeting is what would happen to the silver market when JP Morgan switched from being short on its paper silver contracts, to being long on its large physical silver holdings.

Tom also discusses that sources out of Singapore warn of gold and silver inventories eventually being wiped out by Central Banks and Sovereign wealth funds.

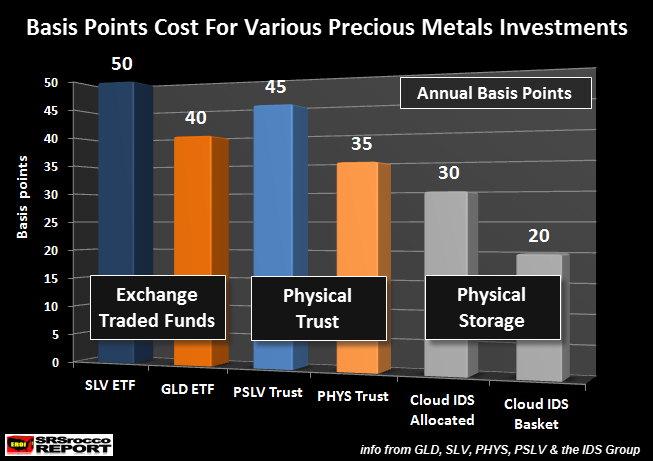

In the next part of the update, Tom explains some new Precious Metals Storage programs for those who are interested in storing metals away from their home or even out of the country. Tom Cloud Hard Assets offers some of the least expensive precious metals storage programs in the world. He even talks about how an investor is paying more to store metal at the SLV ETF (NYSE:SLV), where it is nearly impossible to get the metal, other than storing physical silver at one of his storage programs.

Tom then discusses a conversation with a billionaire who just recently came to the understanding that all his wealth was tied into paper assets.

The most critical thing for investors to understand is that 99% of the their wealth is tied into paper assets or real estate. Diversifying all one’s wealth into stocks, bonds or real estate is not the wise thing to do, especially with the upcoming energy crisis.

Here is a comparison of Tom Cloud’s physical storage costs compared to other precious metals investment vehicles:

2017 will likely turn out to be quite interesting in the markets. Maybe it’s time to consider really “Diversifying” one’s portfolio with real hard assets.