Gold price is testing the $1,310 support and is in a short-term downtrend. Price is expected to continue lower towards $1,280 but first we could see a bounce towards $1,330-35 where a shorting opportunity will arise.

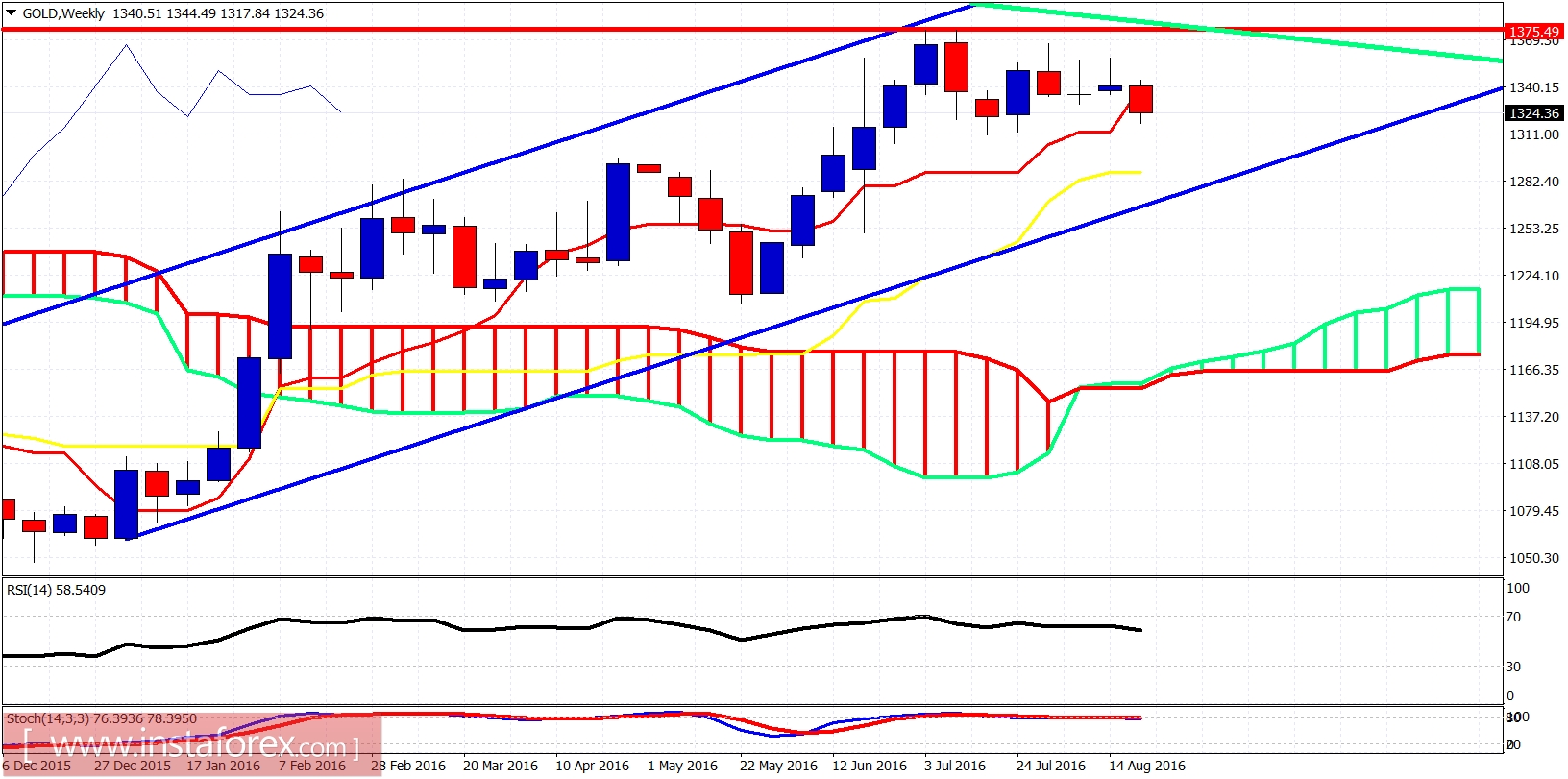

Red lines - bearish channel

Green rectangle - support area

Gold price is trading inside the bearish red channel and is below the Ichimoku cloud in the 4 hour chart. Price could bounce towards $1,330-40 area before continuing its downtrend towards $1,280 which is my minimum pull back target.

The weekly candle is below the weekly tenkan-sen (red line indicator) and if the week closes this bad, we should expect more bearish weeks ahead that could push price even towards $1,200.

Bulls need to be cautious and any bounce should be seen as opportunity to exit longs. Gold price is in a correction phase and has already started a pull back.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.