John Wiley & Sons Inc. JW.A is scheduled to report fourth-quarter fiscal 2016 financial numbers before the opening bell on Jun 14.

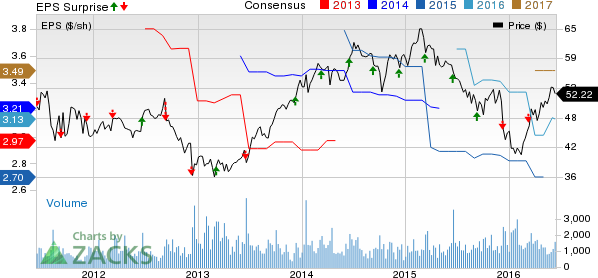

In the fiscal third quarter, the company registered a negative earnings surprise of 11.8%. Nonetheless, the company had surpassed the Zacks Consensus Estimate in two of the trailing four quarters, with an average earnings surprise of 2%. Here’s a discussion on the determinants of its fiscal fourth-quarter results:

Zacks Model Shows Unlikely Earnings Beat

Our proven model does not conclusively show that John Wiley & Sons is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. John Wiley & Sons has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at earnings of 66 cents. The company holds a Zacks Rank #2, but a 0.00% ESP makes surprise prediction difficult.

Factors Influencing this Quarter

John Wiley & Sons continues to face weak demand for printed books. Revenues for printed educational text books fell 16%. Sales for printed books from Professional Development were also down 1% in the fiscal third quarter. Management has already cautioned that the overall book market will remain under pressure in the near future. Management is streamlining its books portfolio to focus on higher value content and is handling expenses accordingly.

In an effort to attract more customers, the company is introducing a time-based journal subscription along with new database choices for customers in its established markets. This facility will allow customers to access the company’s entire journal portfolio instead of title-specified options. This will help the company manage its subscriber agreement. In addition, this transformation will generate nearly $37 million of revenues and 40 cents of earnings per share (EPS) in fiscal 2017, up from the previous estimate of $35 million of revenues and 35 cents of EPS.

Stocks Poised to Beat Earnings

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Rite Aid Corporation (NYSE:RAD) has an Earnings ESP of +20.00% and a Zacks Rank #3.

Constellation Brands Inc. (NYSE:STZ) has an Earnings ESP of +1.97% and a Zacks Rank #3.

The Kraft Heinz Company (NASDAQ:KHC) has an Earnings ESP of +2.86% and a Zacks Rank #3.

WILEY (JOHN) A (JW.A): Free Stock Analysis Report

RITE AID CORP (RAD): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

KRAFT HEINZ CO (KHC): Free Stock Analysis Report

Original post

Zacks Investment Research