Last week, the RBA lowered Australian interest rates 25 basis points, to 1.75%. The press release contained the following paragraph:

Inflation has been quite low for some time and recent data were unexpectedly low. While the quarterly data contain some temporary factors, these results, together with ongoing very subdued growth in labour costs and very low cost pressures elsewhere in the world, point to a lower outlook for inflation than previously forecast.

The paragraph provides ample fodder for analysts’ belief that low inflation was the primary reason for the cut. After all, the topic sentence describes inflation as “unexpectedly low.” While the next sentence concedes temporary factors are at least partially responsible, it also discusses a wider range of disinflationary pressures, including weak labor cost growth and low global inflation.

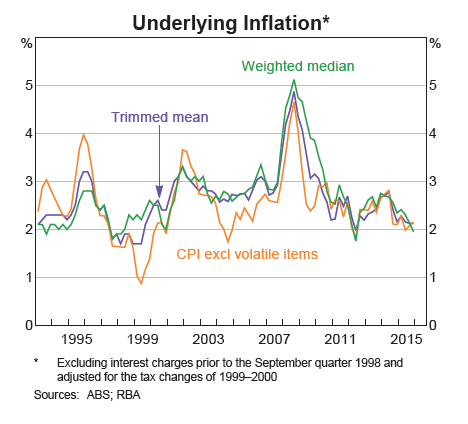

But is dis-inflation really a growing problem? The data isn’t as conclusive:

The above graph plots three CPI measures: trimmed mean, weighted mean and CPI excluding volatile items. All three are near 2%—hardly a panic level.

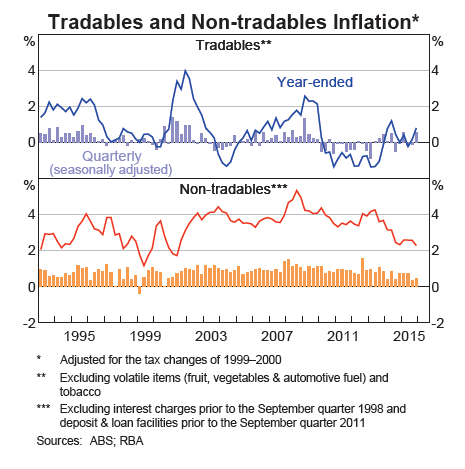

Tradables inflation (top chart, blue line) is weak but rose from negative levels several years ago. And non-tradables inflation (lower chart, red line) is slightly above 2%—again, a comfortable level for inflation.

And while overall inflation recently dipped below 2%, it's a new development. And its past behavior indicates a return to over 2% is likely.

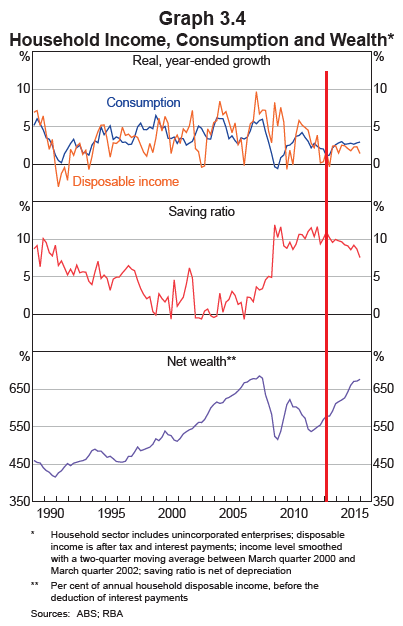

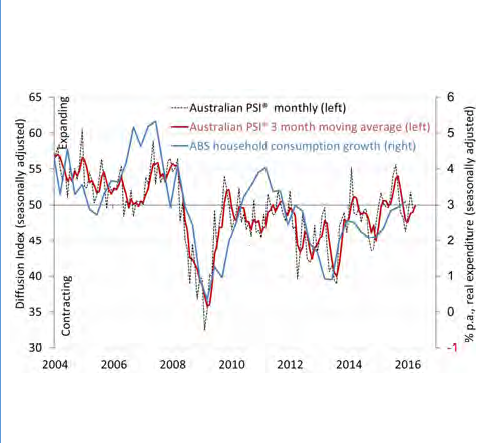

Other economic numbers are strong, arguing against a rate cut. GDP growth fluctuated between 2%-3% for the last 5 quarters. After peaking at 6.4% at the beginning of 2015, unemployment has steadily declined to its current 5.7% level. The wealth effect, where an increase in asset prices leads to increased spending, is clearly supporting household expenditures:

Overall wealth (bottom chart) increased steadily for the last 4 years, supporting a solid 2-2.5% growth rate in consumption (top chart, blue line). This has increased slightly faster than disposable income (top chart, gold line) forcing households to liquidate some of their savings (middle chart). But at slightly less than 10%, there are ample savings for households to spend.

The monetary policy statement only contained one reference to business, noting:

“[T]he available information suggests that the economy is continuing to rebalance following the mining investment boom.”

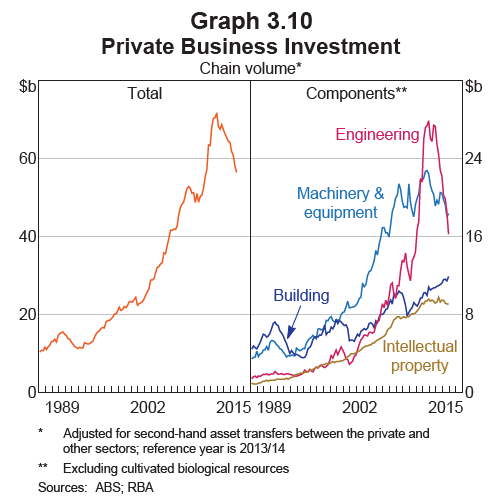

As the following graph shows, the “rebalancing” has in fact involved a sharp drop in capital expenditure:

Total investment (left graph) dropped sharply over the last few years, caused by a leveling off of capital investment and drop in engineering commitments (right graph). This drop has been expected for some time; the RBA has noted it on numerous occasions over the last few years.

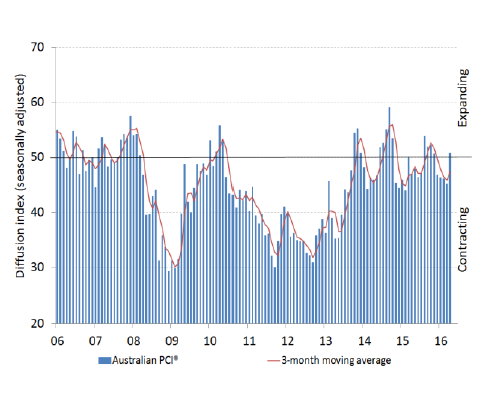

But basic materials aren’t the only weak Australian business sector. The service and construction sectors are also struggling:

The top chart is the Australian Industry Groups construction indicator and the bottom chart is AIG’s services number. Both are very weak and have been for several years. Such weakness could naturally lead to central bank stimulus, such as a rate cut.

Why wouldn’t the RBA simply state that a weak business environment caused the rate cut? For several reasons, most importantly to prevent the negative impact on consumer sentiment that such an announcement would cause. Central banks must be very circumscribed in their public communications, so as not to set off a panic. Additionally, other economic numbers are fairly positive; unemployment is declining and growth is fairly strong. Finally, the RBA wants to be seen as stewards of the entire economy, not pawns of a narrower business constituency.