Strong demand for machinery and steel led U.S. factories to increase production in February, according to Federal Reserve data that suggested a manufacturing slowdown could be easing.

Data released on Wednesday showed U.S. factory output rose 0.2 percent last month, which was a little stronger than the 0.1 percent gain expected by economists in a Reuters poll.

Overall industrial output fell 0.5 percent during the month, dragged lower by sagging oil production and a drop in utilities output.

Manufacturing, which makes up roughly a tenth of the U.S. economy, has cooled over the last year, hit by slower overseas demand and several months of dollar appreciation. A steep decline in oil prices also hit the U.S. energy sector, reducing demand in some factories.

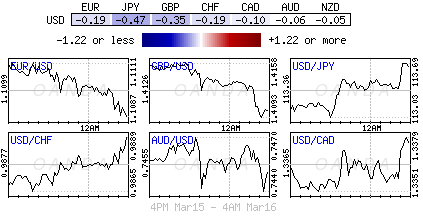

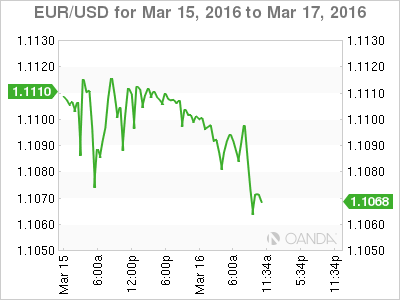

But the dollar has weakened recently, and the outlook for U.S. domestic demand has improved due to robust job growth. On Wednesday, the dollar was nearly 3 percent weaker against a basket of currencies (dollar index) on a year-over-year basis.

In February, U.S. output of goods meant to last at least six months rose 0.4 percent, led by gains in output of primary metals and machinery.

Economists polled by Reuters had forecast overall industrial production falling 0.3 percent last month.

The utilities index fell 4 percent after surging 4.2 percent a month earlier.

With output on the rise, the percentage of industrial capacity in use fell to 76.7 last month from 77.1 in January.

The Fed views capacity use as a leading indicator in deciding how much further the economy can grow before sparking higher inflation.