The Japanese yen is showing limited movement on Wednesday, as USD/JPY trades at 111.80 in the European session. In economic news, Japanese SPPI, which measures corporate inflation, dipped to 0.2% in January. In the US, today’s key release is New Home Sales. On Thursday, the US releases two key events – Core Durable Goods Orders and Unemployment Claims.

The yen continues to radiate strength against the US dollar. February has been especially kind to the Japanese currency, which has jumped 7.6% against the greenback. Japanese fundamentals have not impressed, as GDP contracted in the fourth quarter, Japanese consumer spending has fallen off, hurting growth and deflation remains a serious concern. Despite the limping Japanese economy, the yen has taken full advantage of its traditional safe-haven status, as global financial turmoil has driven investors away from risk assets towards safer waters like the yen. However, weak fundamentals are likely to continue, and the BOJ may have to take further monetary action at its next policy meeting in March. At the January policy meeting, the BOJ adopted negative interest rates, shocking the markets and sending the yen sharply lower before the currency rebounded. Further easing steps would likely push the high-flying yen to lower levels.

USD/JPY Fundamentals

- 9:45 US Flash Services PMI. Estimate 53.4 points

- 10:00 US New Home Sales. Estimate 522K

- 10:30 US Crude Oil Inventories. Estimate 2.0M

- 19:00 US FOMC James Bullard Speaks

Upcoming Key Events

Thursday (Feb. 25)

- 8:30 US Core Durable Goods Orders. Estimate 0.2%

- 8:30 US Unemployment Claims. 271K

- 18:30 Tokyo Core CPI. Estimate 0.0%

*Key releases are highlighted in bold

*All release times are EST

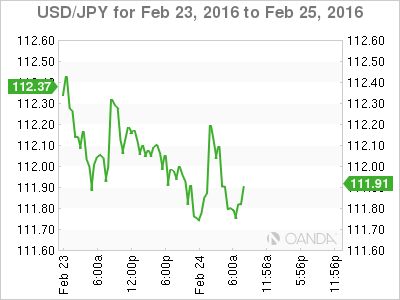

USD/JPY for Wednesday, February 24, 2016

USD/JPY February 24 at 7:55 EST

Open: 111.90 Low: 111.63 High: 112.27 Close: 111.80

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 108.58 | 109.87 | 111.50 | 112.48 | 113.86 | 114.65 |

- USD/JPY has shown limited movement in the Asian and European sessions

- 111.50 is providing weak support

- There is resistance at 112.48

- Current range: 111.50 to 112.48

Further levels in both directions:

- Below: 111.50, 109.87 and 108.58

- Above: 112.48, 113.86, and 114.65

OANDA’s Open Positions Ratio

USD/JPY ratio continues to show little movement. Long positions retain a strong majority (66%), which is indicative of strong trader bias towards the pair breaking out and moving upwards.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.