There are over 1300 ETFs right now, with another 900 in registration. This explosion of alternatives is great for driving down fees and giving investors choices. However once we figure out what we want to buy, we often discover the fund we chose is lightly traded—perhaps only hundreds of shares are traded on any given day.

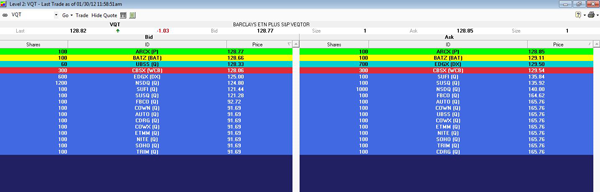

With a lightly traded fund the bid/ask spread is usually significantly wider than the one cent spreads we see with the big ETF funds and stocks. The thumbnail below (click to enlarge) is from Fidelity Active Pro’s order book of Barclays’ VQT. The fund has almost $200 million in assets under management—but its order book is still ugly.

The best quoted bid/ask spread is $0.08—not great but only a 0.06% hit on the overall value of the trade. However, those quotes are only for 100 shares. For 200 shares the spread widens to $0.44, and for 1000 shares the visible book widens to 125/129.54—a chilling $4.54 spread.

If someone was careless enough to enter a market order to sell 1000 shares the likely result would an average price of 126.86—1.5% lower than the best bid price. Perhaps a market maker would step in to prevent this sort of carnage, but there are no guarantees.

Which brings us to rule #1: Always use limit orders unless the security you are trading has narrow spreads and deep liquidity.

However things are not nearly as grim as they seem. Unlike stocks, ETFs have built in processes to provide liquidity when needed. This share creation / redemption process enables companies designated as Authorized Participants (APs) to routinely respond to the market’s demand/distain for ETFs shares in 50K+ share increments.

For example, if market forces are causing a ETF’s price to drift higher than its net asset value (NAV), then an AP can step in and execute a profitable, essentially risk free arbitrage transaction that creates more shares. The AP (and the ETF) are happy to create shares until the increased supply has driven the market price down close to the NAV value. The reverse situation, with the ETF price below the NAV is also profitable for the AP to correct by redeeming shares.

This brings us to rule #2: Know what the NAV value of your ETF/ETN before you trade.

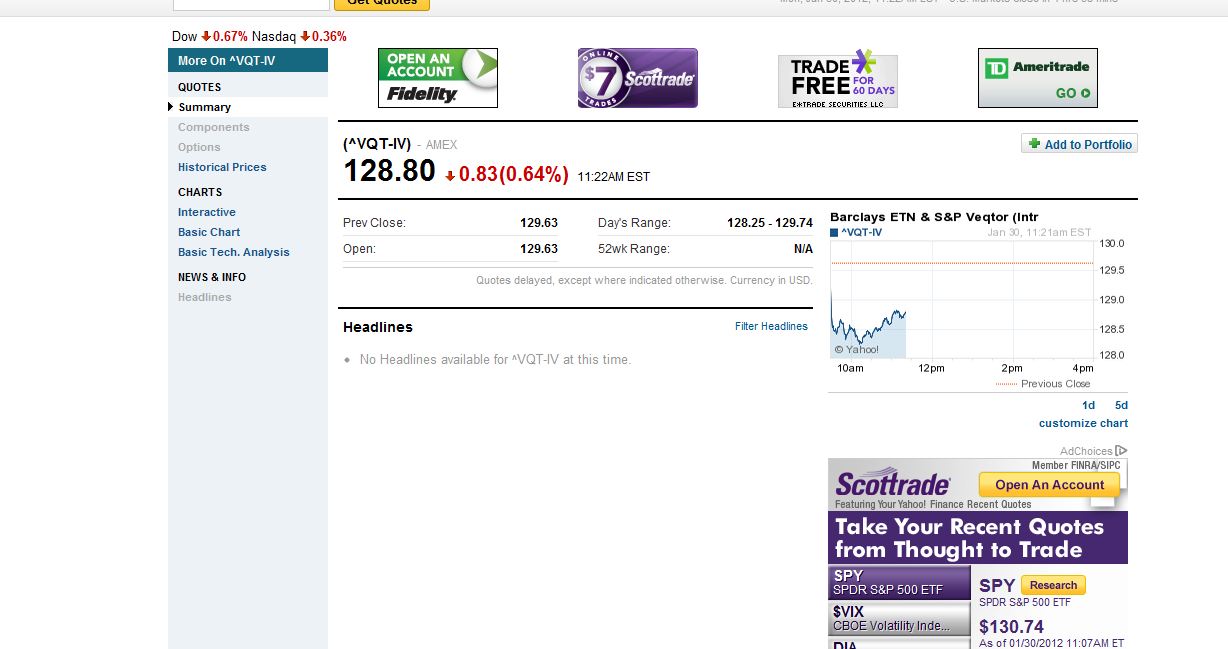

The NAV value is available on Yahoo Finance by adding a “^” to the beginning of the symbol, and a “-IV” to the end. For example the NAV symbol for VQT, is ^VQT-IV. On Bloomberg add IV:IND to the end of the symbol to get, VQTIV:IND. See the thumbnail below for an example NAV quote. You will probably won’t be able to buy or sell at the NAV price, but you should be able to get close.

Knowing the NAV value will help you recognize if the market is out of balance. Normally the NAV will be close to the middle of the bid/ask spread—if not be especially careful.

If your trade is going to be large (e.g., 10,000 or more shares) you should work with liquidity providers like Wolverine, Knight, or Wallachbeth to see if they can facilitate your trade. There is an excellent IndexUniverse webcast that includes some demos of how these firms can provide great quotes for even million share transactions on lightly traded ETFs.

If your trade is small, say 100 shares or less, then a limit order should be fine. If you want to score a few pennies on the spread you can try placing your order between the bid/ask price and see if it fills. If it doesn’t execute you can cancel your order and improve your offer until it does complete.

For larger orders things get a bit trickier. I’ve tried “all or none” limit orders without much success. What has worked for me is a limit order set within the bid/ask price, biased a few cents in the market maker’s favor. If I’ve specified a good limit price I will see partial fills in 100 share blocks over the span of a minute or two until the order is complete.

You only pay your commission once, assuming the order completes within the trading day. Of course there are risks to this; the market might move against you, or liquidity might be exhausted, but compared to the risk of a lousy price these are good risks to take.

And rule #3: Even lightly traded ETFs typically have good liquidity, but its your job to coax it out.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trading ETFs Without Getting Fleeced

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.