The January 2012 numbers for Social Security (SS) show a mixed picture. The results mirror what is going on in the economy. There is clear evidence that revenues at SS are recovering; there is equally clear evidence that America’s social expenditures are rising at a rate that exceeds the rate of recovery.

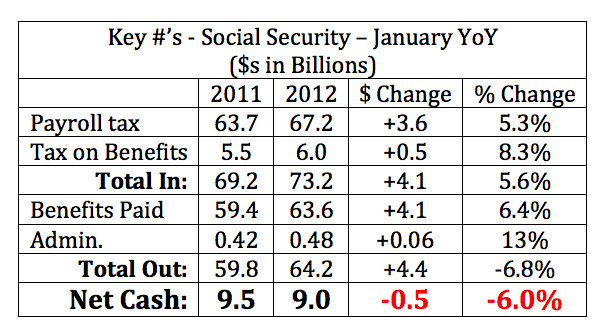

The following numbers are adjusted for any consequences of the 2% payroll tax deduction for 2011 and 2012. As a reminder, the Treasury pays into to SS every month an amount equal to the 2% shortfall. The country ends up more indebted, but there is no net consequence to SS. Some YoY comparative data on the key numbers:

Clearly, the problem is that benefit payments are increasing more rapidly than revenues. There are two contributing forces pushing up costs, (1) 10,000 additional people sign up for benefits every day of the week and (2) inflation (COLA) is rising. The January 2012 YoY increase in benefit payments was $4.1B. Of that amount, approximately $2.1B is attributable to inflation; the balance of $2B is due to more folks getting checks.

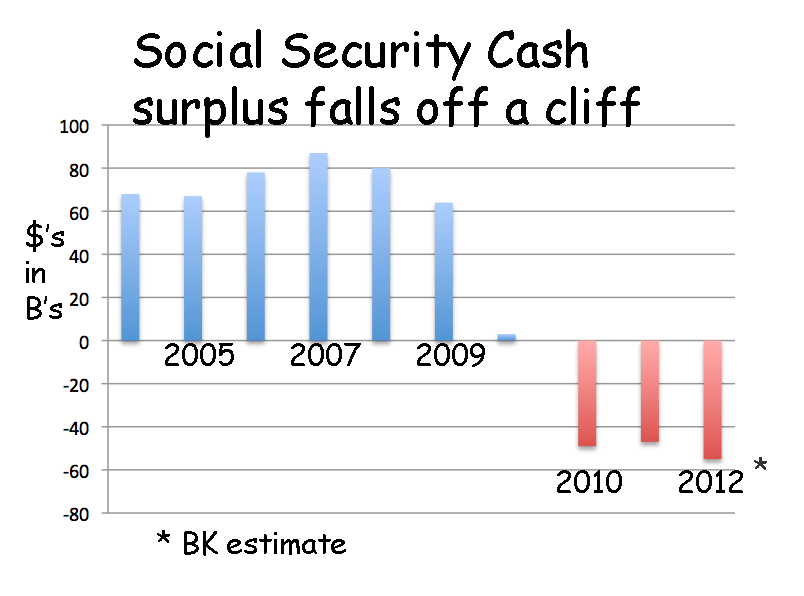

We crossed a big corner at SS in 2010 when the first annual cash flow deficit was reported. SS will never again see a cash surplus. The only question is how rapidly the deficits will rise. It’s a bit early in the year for me to provide a credible 2012 forecast for SS. My read of the January numbers confirms my suspicions. The improvement in the economy will be trumped by increasing benefit costs. Net-net, a modest deterioration in the cash position is my base case. I think SS will produce a $56B cash shortfall in 2012 (2010 = -49B, 2011 – 47B). The changes in the net cash position at SS over the past seven years show the extent of the deterioration:

The expense side of the SS equation can’t be altered. The only variables that make a difference are interest rates and the economy (jobs).

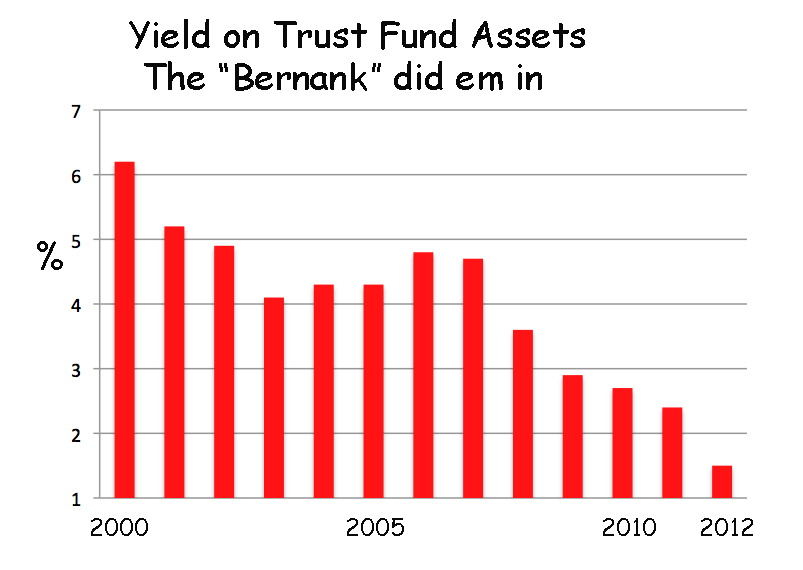

The interest rate side of the equation is easy to contemplate. SS’s income from interest is going to decline in 2012 and beyond. Ben Bernanke’s ZIRP, QE and Twist have seen to that. Ben has made it clear that interest rates will remain at historical lows for well into the future. SS is America’s biggest saver ($2.6 Trillion), it will therefore pay a price as the low interest rate environment is endlessly extended.

In June of this year, SS will re-invest its maturing bonds (and any cash it has) in a new strip of securities that have maturities from 1 to 15 years. The interest rate for these Special Issue Treasury Securities is set by a (stupid) 60-year old formula. This year, the formula will produce a yield for the new investments that is the lowest in history. Take a look at the historical interest rates that SS has received on its surplus:

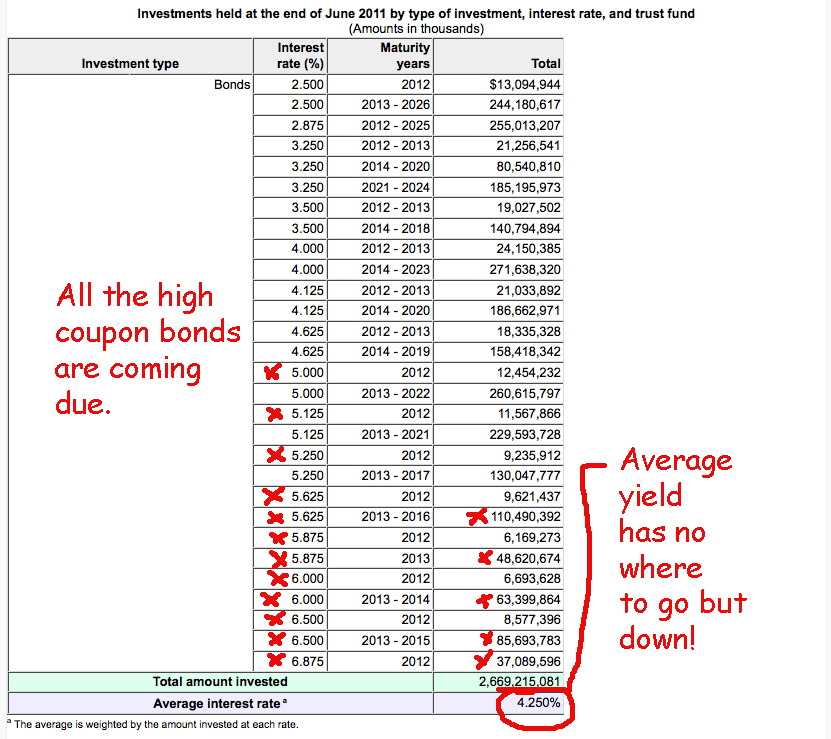

The following shows the maturities and the interest rates on SS's holdings of Treasury securities. Note that in the next few years, all of the high coupon bonds will be rolling off. The old bonds will be replaced with much lower yielding assets.

This is the expectation for interest income at SS based on its 2011 report to Congress:

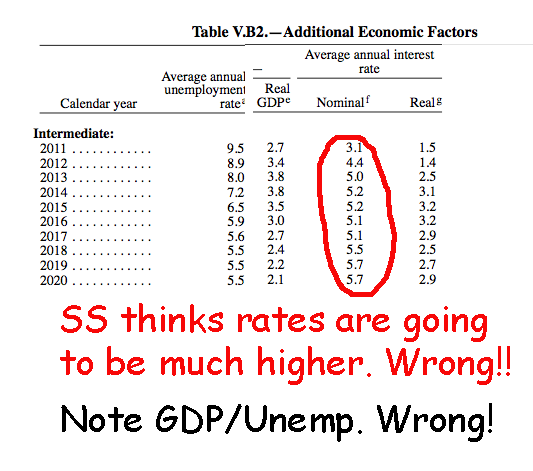

Here is the forecast on interest rates on which the above interest income forecasts were made.

This simply does not add up. SS will have to significantly revise downward its projections for interest incomes (there is no way the Fed is going to back off ZIRP anytime soon).

The economy is much harder to ponder. As of today, there is a case than can be made for continued job growth. But for how long? America has a bad habit of slipping into a recession every four years or so. The last one was in 2008, so we’re due. I think that the US will muddle through the first part of 2012 with continued modest job growth. However, a slowdown looks to be in the cards by the end of the year. As of today, there are a dozen economic headwinds that will kick in as of 1/1/13 - all of the Bush tax cuts, the SS payroll reduction and a substantial cutback in government spending (the sequestered amounts).

If we experience a recession in 2013, and the Fed maintains its low interest rate policies, it will be a very bad year for SS. The cash deficit would explode under these conditions. It could easily exceed $100b. The wheels will come off of SS’s cart. As we are seeing now, it is extremely difficult for SS to bounce back in good times. it will be impossible if we hit another economic slow patch.

This is precisely the scenario I’m anticipating for 2013. It will be a decisive year. If we end up going down an economic road as I have described, then SS will fall into full deficit (operating cash deficit + interest income). That would happen circa 2015. The Social Security Trust Fund is forecasting this event but it believes it will happen in 2021. When people realize that the Trust Fund has topped out, and the implications are understood, significant changes at SS will follow.

I point readers to a raging debate going on in Japan. To cover the growing deficits at Japan’s equivalent of SS, consumption taxes are being increased from 5% to 10% on everything purchased in the country. This massive tax increase is far too low to cover the problem. To bring balance to the system, VAT taxes have to rise to 17%.

Japan is in a different situation than the US. Its population is even older (and aging more rapidly) than ours. As in many other examples, the US is about ten-years behind Japan. But we are catching up quickly. In just a few years, America will have a similar raging debate on SS. We too will be faced with a dilemma. Either taxes have to raised, or benefits have to come down. The alternative is that the US follows Japan into the land of 200% debt-to-GDP. Unlike Japan, The US can’t survive at that rate. We will blow up before we get to 200%.

We won't see any reforms in America’s entitlement programs in 2012. The election will see to that. The immediate priorities of 2013 will not include SS. The other problems facing the economy will be more pressing. But by 2014, the jig will be up. By then, there will have been so much damage to SS that a very significant set of changes will be required to minimize what will then be seen as a systemic risk.

Note: I get the occasional beef about using graffiti in my articles. "Phooey" is what I say to that. This one by Banksy is perfect for this piece. No?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Social Security - January 2012 and Beyond

Published 01/12/2012, 01:03 AM

Updated 07/09/2023, 06:31 AM

Social Security - January 2012 and Beyond

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.