After a rather dull day yesterday where the highlights were a rise in US Factory Orders and decelerating Eurozone consumer price inflation we kick it up a notch today with a full calendar, including ADP Employment Change and ISM Non-manufacturing from the US. Add to this jobless claims from the US as usual and a French bond auction and we are in for some action.

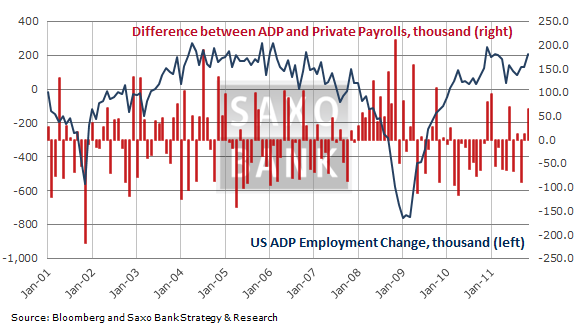

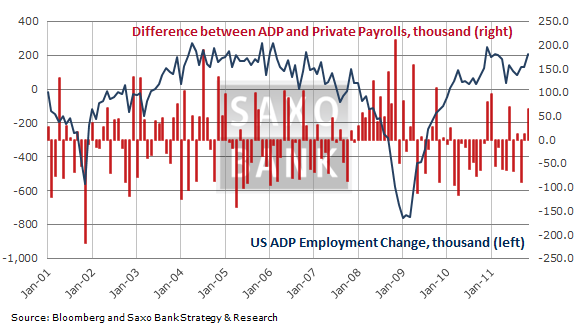

ADP to show another solid month for US labour in December? The oft-maligned ADP Employment report, which does not get much credit in many circles, will come out in its December version today with consensus looking for an increase of 178,000 (private) payrolls versus 206,000 in November. While the ADP often gets a bad reputation as being useless as an indicator of (tomorrow's) Nonfarm Payrolls report, it is not quite that bad. If we look at the last four years the ADP has lagged consensus forecasts quite a bit, but when revisions are taken into account ADP suddenly beats consensus (also note that the ADP should actually be judged against the Private Payrolls series of tomorrow's employment report). Hence consensus may be the better guess if you trade short-term, but ADP may paint a more accurate picture of the actual, underlying strength of the economy.

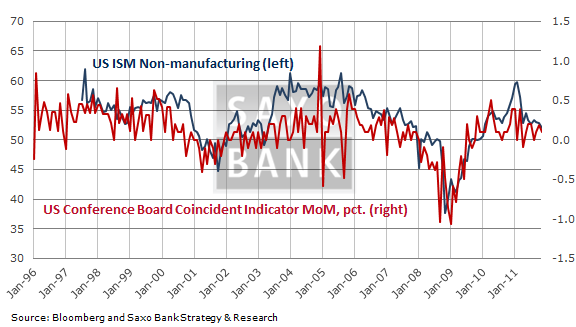

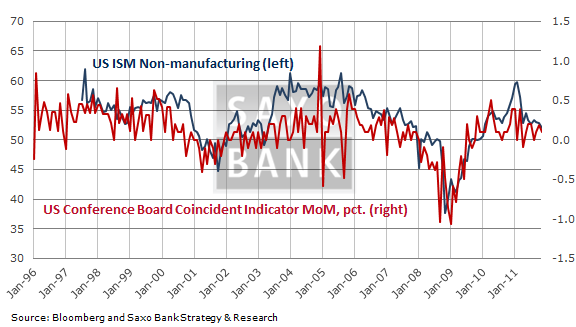

Service sector in the US to follow manufacturing and improve? As the end of 2011 drew to a close the manufacturing sector in the US put out some decent numbers with the December ISM Manufacturing report printing 53.9, the highest level since June's 55.3. The much bigger service sector, meanwhile, has been steady around 53 since March 2011's 57.3 reading, and judging from the components of the November report we are boudn to see more of the same in December. New Orders, Activity, Backlog of Orders and Employment were all more or less in line with readings in recent months; Consensus targets 53. French auction, US jobless claims also on tap: France will attempt to sell 2021, 2023, 2035 and 2041 bonds today at 10:00 GMT, which could mean more worry about the sovereign debt crisis in the markets after yesterday's lukewarm display by Germany. Germany sold EUR 4.1 billion 10-year bonds at a 1.93 percent yield and a bid-to-cover ratio of 1.27.

French auction, US jobless claims also on tap: France will attempt to sell 2021, 2023, 2035 and 2041 bonds today at 10:00 GMT, which could mean more worry about the sovereign debt crisis in the markets after yesterday's lukewarm display by Germany. Germany sold EUR 4.1 billion 10-year bonds at a 1.93 percent yield and a bid-to-cover ratio of 1.27.

Fifteen minutes after the release of the ADP report we have jobless claims from the US where consensus looks for a print of 375,000 from 381,000 a week earlier. The trend has improved lately, which bodes well for tomorrow's Nonfarm Payrolls number (though today's Initial Jobless Claims figure comes too late to be able to affect tomorrow's number).

ADP to show another solid month for US labour in December? The oft-maligned ADP Employment report, which does not get much credit in many circles, will come out in its December version today with consensus looking for an increase of 178,000 (private) payrolls versus 206,000 in November. While the ADP often gets a bad reputation as being useless as an indicator of (tomorrow's) Nonfarm Payrolls report, it is not quite that bad. If we look at the last four years the ADP has lagged consensus forecasts quite a bit, but when revisions are taken into account ADP suddenly beats consensus (also note that the ADP should actually be judged against the Private Payrolls series of tomorrow's employment report). Hence consensus may be the better guess if you trade short-term, but ADP may paint a more accurate picture of the actual, underlying strength of the economy.

Service sector in the US to follow manufacturing and improve? As the end of 2011 drew to a close the manufacturing sector in the US put out some decent numbers with the December ISM Manufacturing report printing 53.9, the highest level since June's 55.3. The much bigger service sector, meanwhile, has been steady around 53 since March 2011's 57.3 reading, and judging from the components of the November report we are boudn to see more of the same in December. New Orders, Activity, Backlog of Orders and Employment were all more or less in line with readings in recent months; Consensus targets 53.

French auction, US jobless claims also on tap: France will attempt to sell 2021, 2023, 2035 and 2041 bonds today at 10:00 GMT, which could mean more worry about the sovereign debt crisis in the markets after yesterday's lukewarm display by Germany. Germany sold EUR 4.1 billion 10-year bonds at a 1.93 percent yield and a bid-to-cover ratio of 1.27.

French auction, US jobless claims also on tap: France will attempt to sell 2021, 2023, 2035 and 2041 bonds today at 10:00 GMT, which could mean more worry about the sovereign debt crisis in the markets after yesterday's lukewarm display by Germany. Germany sold EUR 4.1 billion 10-year bonds at a 1.93 percent yield and a bid-to-cover ratio of 1.27.Fifteen minutes after the release of the ADP report we have jobless claims from the US where consensus looks for a print of 375,000 from 381,000 a week earlier. The trend has improved lately, which bodes well for tomorrow's Nonfarm Payrolls number (though today's Initial Jobless Claims figure comes too late to be able to affect tomorrow's number).