Aussie on the ropes a bit, though the market seems to only see the currency through risk appetite glasses. Those may bet getting blurry and we wonder if there is still far too much complacency Down Under.

After getting off to a positive start, the US session ended yesterday on a sour note as the S&P bond ratings agency announced that it was putting 15 of the 17 Euro area countries under negative review and would likely downgrade if a credible plan is not introduced to deal with the sovereign debt crisis. That the market reacted as strongly as it did was more of a sign that the market had gone too far in the nearest term in pricing in a rosy outcome of this Friday’s EU summit than it was a recognition of the importance of the announcement.

Earlier in the day, Sarkozy and Merkel’s statements on new changes to the EU treaty set off quite a positive reaction, one that was a bit befuddling as it appeared to be very much in line with the expectations building ahead of Friday. At the same time, the exclusion of Euro Bonds was a negative (for the rally-via-liquidity argument) and Sarkozy’s refusal to talk about the ECB’s role in all of this underlines the ongoing uncertainty. The commitment to budget austerity is all well and good, but doesn’t relieve. What has relieved the pressure on the banking system was yesterday’s very dramatic tightening in sovereign debt spreads across Europe. Italian 2-year yields have dropped close to 5.5% today after hitting 8% last week.

RBA cuts:

The RBA statement was very balanced, considering many of the developments abroad. A continued need for easing was flagged and the December ’12 Australian STIR future perked up about 11 ticks, taking back about half of recent losses, so some additional expectation of policy easing going forward was priced back in. But considering the limp to the finish in New York late yesterday and weak Asian markets in today’s session, the move lower in the Aussie was positively sedate. The RBA seems to want to refuse to set off any alarm bells. Mr. Stevens statement, for example merely noted that Chinese growth has slowed “as policymakers intended” and, while a number of external risks related to Europe were outlined, concern on the domestic front remained fairly light.

Robust investment and activity was noted in the resources extraction sector, while softness was noted in non-mining sectors of the economy. Inflation was forecasted to remain in the 2-3% range in the coming two years. By all appearances, the RBA and the market are looking for a very soft landing indeed, and no mention was made on the risks from the Australian housing bubble. Complacency is a word that comes to mind after this statement, though the market needs to move AUD/USD back below 1.00 to suggest that the complacency will be challenged in the near term.

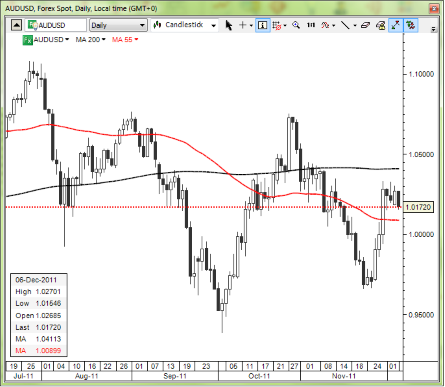

Chart: AUD/USD:

Lines in the sand abound for AUD/USD and risk appetite. In the latter, we’re watching as the US S&P500 flirts with its 200-day moving average (around 1265 on the cash index), which has been a key resistance level since it was broken back in early August. As for AUD/USD, the furious rally off the lows has paused here ahead of its 200-day moving average at around 1.0330. The 1.0085 are was an interesting pivot area of interest recently and could remain a focus, though the obvious psychological battlefront takes place at the parity level.

Looking ahead:

We’ve got three more days of uncertainty ahead of Friday’s summit. It is clear at this point that the critical question is the role of the ECB in all of this and yesterday provided no hint. With so much focus on austerity and budget discipline in Europe, the question becomes one of how steep the decline in European growth fundamentals will prove. Nonetheless, the improvement in peripheral sovereign yields over the last few days has been very impressive and looks like a feather in EU politicians’ cap for now. Still, we only have to look back at the late July efforts to see how quickly trust can fade, so we all need to remain on our toes.

It is interesting to note that the weak Euro on the latest S&P news has failed to see the single currency much weaker against CHF. Is something brewing there? We watch and wait for possible news on negative interest rates or the next floor declaration, etc.. A close well above 1.2400 in EURCHF is the first sign that something is cooking. Meanwhile, USDCHF is close to its 0.9330 high for the cycle.

Watch out for German Factory Orders for October out a bit later as this data tends to lead the key industrial production for Germany. Though the data is a bit old, the steepness of the drop in demand in September was notable.

Watch out for the Bank of Canada rate announcement later today. The market is neutral on the forward view for monetary policy there as the bank has kept the rate at 1.00% for over a year now. Economic data surprises have been deteriorating for Canada over the last month and have turned generally negative.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

RBA Cuts, But Aussie Still Move Sensitive To Risk Picture

Published 12/06/2011, 08:18 AM

Updated 03/19/2019, 04:00 AM

RBA Cuts, But Aussie Still Move Sensitive To Risk Picture

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.