Hedge funds and large investors continue to scale back their long exposure to commodities as the economic outlook for 2012 worsens and it could potentially reduce the demand for raw materials. The European sovereign debt crisis has become a liquidity crisis with banks busy tightening lending. This is reducing the amount these funds have available for margin trading and the impact is now being felt across most markets including commodities.

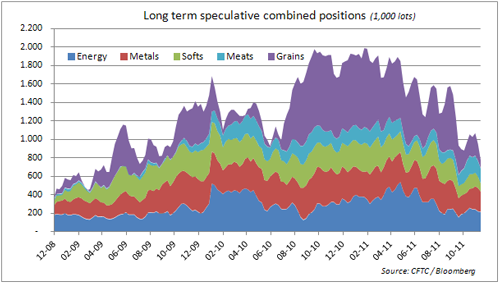

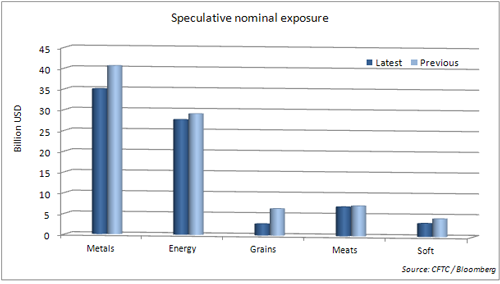

Last week speculators reduced their combined long exposure of futures and options on the 25 commodities we track by 19 percent to 770,000 lots, the lowest level since July 2009 and well below the recent peak of nearly 2 million contracts back in February. In nominal terms the exposure dropped by $12 billion to $76 billion last week.

All sectors saw reductions with the agriculture sector especially suffering a 34 percent setback as global grain growers will produce a record in 2011 thereby responding strongly to the high prices seen in 2010 and early 2011.

The grain sector tumbled with long exposure to corn, the darling of the grain markets, dropping by 22 percent. The overall long exposure to grains now sits at only 84k lots, down from 865k lots in February when worries about this year's crop reached boiling point. The short position in the soy complex, which comprises soybeans, soy meal and soy oil, grew for the second week reaching -45K lots.

Energy sector relatively unscathed with small reductions in WTI, Heating oil and gasoline being offset by an almost equal reduction in the natural gas short position. The metal sector saw reductions across the board with investors trimming long positions in gold after the failure to make further progress while the short position in copper nearly tripled.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Speculative Longs Cut To The Lowest Since July 2009

Published 11/29/2011, 07:35 AM

Updated 03/19/2019, 04:00 AM

Speculative Longs Cut To The Lowest Since July 2009

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.