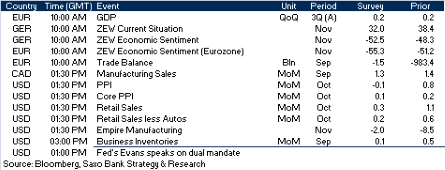

A quiet start to the week yesterday with only Eurozone production reported will be overshadowed today by plenty of important numbers including: Eurozone GDP, US PPI and Retail Sales plus German ZEW - making it one of the more busy data days of the year.

Eurozone economy grew in third quarter: In yesterday's post we looked at Industrial Production versus GDP and found that according to output GDP would likely rise around 0.6 percent quarter-on-quarter. We cautioned, however, that production could well over-estimate GDP somewhat due to the drag from the public sector. With German and French GDP already released today showing growth of 0.5 and 0.4 percent, respectively (with mixed revisions, +0.2 and -0.1 pct.) the overall Eurozone GDP growth could well land somewhere between the consensus forecast of 0.2 percent and the prediction from Industrial Production.

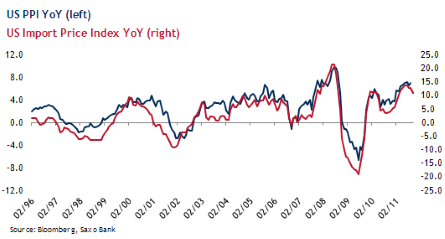

US producer prices to ease? Inflation in the US has moderated a bit in recent months with PPI growing 6.9 percent year-on-year, having been in a range of 6.5-7.2 percent since April. Import prices, usually a good indicator of PPI, have eased to a still high annual growth rate of 11 percent from a peak of 13.7 in July, suggesting that PPI may also continue to decelerate further in the coming months. Consensus looks for -0.1 percent month-on-month or 6.3 percent year-on-year.

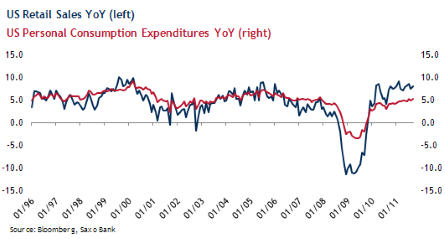

US retailers sees continued growth: Retail Sales have grown robustly in the US this year despite the slump in overall economic activity. The problem, however, is that Retail Sales have not accelerated enough to keep up with rising inflation meaning that real spending is coming down. Add to this the fact that the savings rate is at its lowest level of 3.6 percent since December 2007 - implying that consumers have lowered their savings rate to continue to spend at a roughly unchanged rate - and the case for continued spending growth is conditioned on a pick-up in the labour market, specifically income and wages. For October consensus looks for a 0.3 percent increase in Retail Sales and 0.2 percent excluding autos.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Data Galore Led By Eurozone GDP, US Retail Sales, PPI

Published 11/15/2011, 01:07 PM

Updated 03/19/2019, 04:00 AM

Data Galore Led By Eurozone GDP, US Retail Sales, PPI

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.