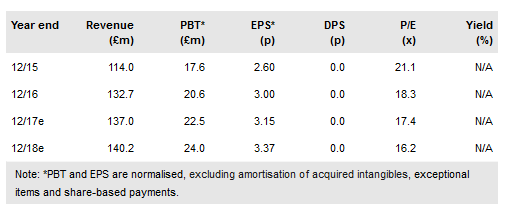

QE’s diversification strategy delivered a 17% jump in adjusted profit before tax during FY16. Strong growth in photonics revenues was a key element of this improvement. This was boosted by a return to growth, albeit modest, in the wireless sector and weak sterling. We revise our FY17 estimates upwards to reflect the progress made on customer qualifications for photonics applications, and we introduce FY18 estimates.

FY16 benefited from photonics growth and forex

Group revenues grew by 16% y-o-y, to £132.7m, in line with our £129.0m estimate. Trading was strong in multiple markets throughout FY16, with wireless revenues returning to growth (15%) and photonics recording a 43% increase. The two key applications – vertical cavity surface emitting lasers (VCSELs), which are used in data communications, consumer and industrial applications; and indium phosphide (InP), which is used in fibre to the premises and other short-haul optical networks – are experiencing strong demand. Revenues also benefited from weakness in sterling throughout the year. Adjusted profit before tax rose by 17% to £20.6m, in line with our £20.3m estimate.

To read the entire report Please click on the pdf File Below