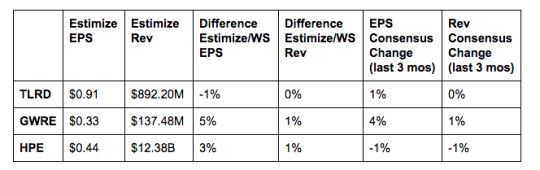

Tailored Brands (NYSE:TLRD): Quarterly results have been mixed recently due to the difficult consumer and retail environment. These conditions are steadily improving as witnessed by the resurgence started by Macy’s (NYSE:M) earlier this season. Tailored Brands could greatly benefit from a victory this quarter as shares are down 75% in the past 12 months. Its two flagship brands, Men’s Wearhouse and Jos A. Bank have delivered abysmal results despite frequent discounting. Last quarter Men’s Wearhouse delivered a comparable sales decline of 3.5% with Jos A. Bank dropping 16%. Given how poorly the company has performed its not surprising that the stock historically drops 2% immediately following an earnings report.

Guidewire Software (NYSE:GWRE): Guidewire has been a strong performer with both earnings and revenue steadily improving in recent quarters. The stock has followed this trend up with shares up 5% year to date and nearly 18% in the past 12 months. License revenue last quarter was up 38% thanks to growing adoption of its technology based P&C insurance platform. The acquisitions of EagleEye Analytics and FirstBest Systems should continue to tie modern software with complex risk analysis. Its biggest concern will be whether they can sustain the strong top and bottom line growth moving forward.

Hewlett Packard Enterprise (NYSE:HPE): HP is almost a year removed from a split that formed Hewlett Packard Enterprises. The move separated the struggling hardware business from the prosperous software services. In an effort to become even leaner, HPE split from its long-troubled services unit. What remains is a world leader in servers and data centers that competes with heavy hitters like Cisco Systems (NASDAQ:CSCO). HPE shares are up 33% since the spinoff with expectations of making additional gains following its report. The report should highlight how the company is progressing without the dead weight and whether or not they have found a bidder for its software unit.