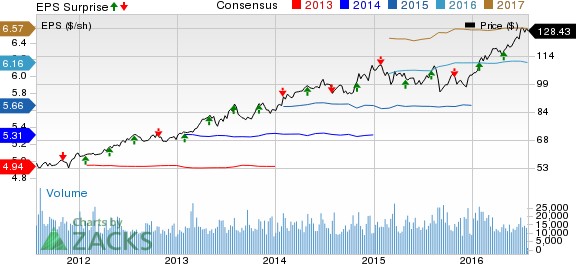

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2016 adjusted earnings of $1.67 per share, outpacing the Zacks Consensus Estimate of $1.58 by 5.7%. Reported earnings also soared 7.1% year over year on the back of higher earnings from its subsidiary, NextEra Energy Resources (“NEER”).

On a GAAP basis, NextEra Energy registered second-quarter earnings of $1.16 per share compared to $1.59 earned a year ago. The variance between adjusted and GAAP earnings was due to an unrealized mark-to-market loss of $1.18 from non-qualifying hedges, income tax related benefit of 12 cents, and gain from an asset sale of 55 cents.

Total Revenue

In the second quarter, NextEra Energy’s operating revenues were $3,817 million, lagging the Zacks Consensus Estimate of $4,459 million by 14.4%.Reported revenues decreased 12.4% from $4,358 million a year ago.

Segmental Results

Florida Power & Light Company (FPL): Earnings came in at 96 cents per share compared with 97 cents in the prior-year quarter. Revenues stood at $2,750 million, down 8.2% year-over-year.

NextEra Energy Resources (NEER): Quarterly earnings came in at 67 cents per share, up from 57 cents in the year-ago quarter. Revenues amounted to $970 million, down 23.4% from the prior-year quarter.

Corporate and Other: Quarterly earnings increased from the year-ago level of 2 cents to 4 cents. Revenues in the reported quarter came in at $97 million, up 2% from the year-ago period.

Operational Update

In the reported quarter, NextEra Energy’s total operating expenses were down 17.6% to $2,648 million, primarily due to lower fuel, purchased power and interchange, lower merger-related expenses and lower taxes other than income taxes.

Operating income grew 2% to $1,169 million from $1,146 million a year ago.

NextEra’s interest expenses in the reported quarter were $602 million, up from $280 million in the prior-year quarter due to debt issuance.

Financial Update

NextEra Energy had cash and cash equivalents of $730 million as of Jun 30, 2016, compared with $571 million as of Dec 31, 2015.

Long-term debts as of Jun 30, 2016 were $27 billion, up from $26.7 billion as of Dec 31, 2015.

NextEra Energy’s cash flow from operating activities in the first six months of 2016 was $3.3 billion, compared with $2.9 billion in the year-ago period.

Guidance

NextEra reiterated its earnings guidance of $5.85–$6.35 for 2016 and $6.60–$7.10 for 2018. The company expects earnings to grow at a compound annual growth rate of 6% to 8% per year through 2018, off a 2014 base.

Upcoming Peer Releases

NiSource Inc. (NYSE:NI) is slated to report second-quarter 2016 earnings on Aug 2.The Zacks Consensus Estimate stands at 6 cents.

PG&E Corporation (NYSE:PCG) scheduled to report second-quarter 2016 earnings on Jul 28.The Zacks Consensus Estimate stands at 94 cents.

NRG Energy, Inc. (NYSE:NRG) is slated to report second-quarter 2016 earnings on Aug 9.The Zacks Consensus Estimate stands at breakeven results.

Zacks Rank

NextEra energy currently carries a Zacks Rank #4 (Sell).

NEXTERA ENERGY (NEE): Free Stock Analysis Report

NISOURCE INC (NI): Free Stock Analysis Report

PG&E CORP (PCG): Free Stock Analysis Report

NRG ENERGY INC (NRG): Free Stock Analysis Report

Original post

Zacks Investment Research