When the Panama Canal expansion is finally finished this spring, the canal will have two new features:

1. It will serve larger ships that can carry up to 3x as many containers

2. It will serve liquified natural gas (LNG) carriers

It is not entirely clear what effects this will have on world trade, but Panama’s hope is that, in spite of a recent shipbuilding trend toward vessels so large they will exceed even the acceptable post-expansion canal dimensions, the new canal will help to make it cheaper and easier for the commodities and consumers of the Atlantic world to access the industrial economies of the Asia-Pacific.

Like any other major infrastructure project, the canal expansion could create a number of winners and losers, all other things being held equal. Let’s briefly speculate on which nations these will be:

Possible Winners:

South Korea, Taiwan, Trinidad, El Salvador, Colombia

LNG markets may be the key to understanding which economies will benefit most from the expanded canal, because LNG cannot pass through the present-day canal, but will be able to post-expansion.

In recent years, natural gas prices have been around 5-10 times higher in East Asia than in North America. Today they are $1-2 per BTU in the US, compared to $8-9 in Japan and $5-6 in Germany.

The “shale revolution” has unlocked gigantic supplies of natural gas in the US near the Gulf of Mexico, where there already a large number of LNG import facilities that could converted into LNG export facilities. The existence of these facilities is significant, as it is considerably cheaper and faster to retrofit an existing plant than it is to build an LNG export terminal from scratch.

The United States, to be sure, currently has the greatest number of LNG export projects in the world being planned, with the vast majority of these projects located along the Gulf coast, not so far away from Panama. Even though only one of these facilities, Louisiana’s Sabine Pass, is expected to be finished prior to 2019, the early 2020s could see many more come to fruition.

South Korea and Taiwan

A typical assumption has been that China and Japan will be the primary beneficiaries of the canal. China, after all, leads the world in importing commodities and exporting bulk goods, and Japan has accounted for 40% of the world’s LNG imports – far more than any other country – in recent years.

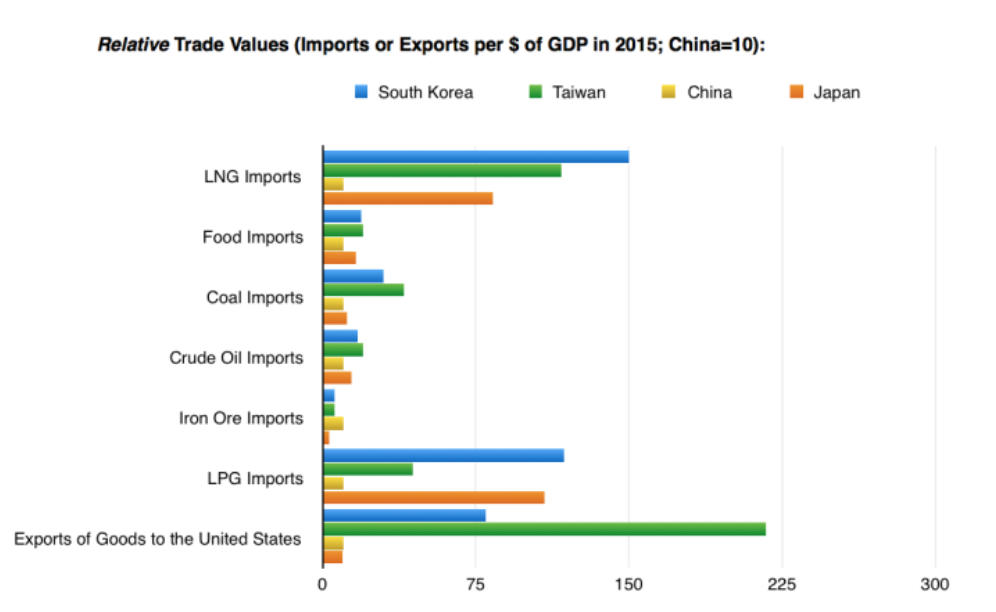

Yet while China and Japan lead the pack in terms of the value of their absolute trade, they lag far behind both South Korea and Taiwan in the more relevant category of relative trade; that is, the value of their trade relative to the overall size of their economies.

As can be seen in the chart below, the economies of China and Japan are not as trade-oriented as those of South Korea and Taiwan. As such, they might not benefit as much from the canal, which is intended to ease trade.

LPG stands for Liquid Petroleum Gasses, such as ethane, propane, and butane. The canal expansion is supposed to help these as well.

Of course, none of this means that South Korea and Taiwan are risk-free investments. They are not. Ceteris paribus, though, they appear likely to be two of the greatest beneficiaries of the new canal.

Trinidad

Until North American gas is made avaliable to East Asian markets, Trinidad is the sole LNG player in the Americas capable of serving the East. Today, Trinidad is the world’s sixth largest LNG exporter and 23rd largest producer of natural gas in general.

Trinidad exports 3.5 more LNG than Peru, which for the time being is the only other LNG exporter in the Americas. Trinidad also produces more gas in general than any Latin American country outside of Mexico or Bolivia, both of which it trails slightly.

This is a considerable amount of gas production for a country as small as Trinidad, which has a population of just 1.4 million (including its sister island, Tobago, which is home to just 62,000 people). Trinidad is also the world’s largest exporter of ammonia and second-largest exporter of methanol, which often find their way to East Asian markets as well.

Finally, Trinidad is 14 km off the coast of Venezuela, another energy-dependent economy which, in the long term, might benefit by exporting gas and other commodities via the canal.

El Salvador

There are only four countries in the Americas that possess a coastline on the Pacific Ocean yet lack direct access to the Atlantic. These are Chile, Ecuador, Peru, and El Salvador. Of the four, El Salvador and Ecuador are the only two which are located close to the Panama Canal. Indeed, Santiago, the Chilean capital, and Lima, Peru’s capital, are roughly 4500 and 2500 km away from the canal by ship, respectively; El Salvador’s capital San Salvador is 1400 km away.

El Salvador is also the only one of the four to have an economy that is not oriented towards exporting commodities to other Pacific states: Ecuador’s economy is based on exporting oil to Asia and California, Chile’s is based on copper exports, and Peru’s is based on a number of commodities. These do not need to pass through the canal; in fact the canal might cause the price of these resources to fall in Pacific markets, which may, perhaps, hurt these countries’ export revenues.

El Salvador, on the other hand, has an economy that instead depends on its relationship with the US; approximately 25% of Salvadorans worldwide already live in the US, and El Salvador exports lower-end manufactured goods to the US, and imports its refined fuels. Being able to access US markets via the canal, as well as other Atlantic markets like Europe and Brazil, could be a big boon for El Salvador.

Colombia

Colombia is just 230 km from the canal, much closer than any other South American country. Panama was in fact a part of Colombia until the US helped to detach it in 1903, a decade before the completion of the original canal.

Given its proximity, the canal’s expansion could help Colombia’s isolated Pacific coast west of the Andes Mountains interact commercially with its much more developed Atlantic and interior mountain cities. This could potentially allow Colombia to achieve a greater economy of scale, helping it to throw its political and economic weight around as the most populous country in South America apart from Portuguese-speaking Brazil.

Moreover, because Colombia’s vast supplies of coal (it is estimated to be the 10th largest coal producer in the world), coffee (it is the 3rd largest producer in the world), nickel (9th largest), bananas (10th), oil (19th), and other goods are much easier to export via Atlantic rather than Pacific ports — as a result of the navigability of the Magdalena River Valley (see map below), which stretches from the major inland cities of Bogota and Medellin to the Atlantic – the expanded canal will help Colombian commodities to reach East Asian, Californian, and Chilean import markets.

Finally, Colombia has medium-sized natural gas reserves: the 47th largest in the world, according to the CIA Factbook. Indeed, Colombia is the only LNG exporter in Latin America outside of Peru (as Trinidad speaks English, not Spanish). It too could pass gas in the years ahead, in that case.

In a future report, we will discuss the 5 potential “losers” of the Panama Canal’s expansion: Australia, Malaysia, Mexico, Yemen, and Mozambique. We will also discuss how Panama itself may be affected by it.