Market Brief

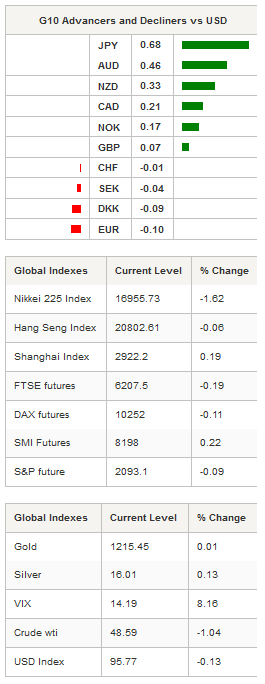

Yesterday, the release of weak economic data from the US cast a cloud over a summer rate hike and acted as a reminder that the recovery is still fragile, especially given the strong dollar. Released on Tuesday, personal income remained stable and matched the median forecast in April increasing 0.4%m/m (s.a.). Personal spending surprised to the upside and beat consensus by increasing 1.0%m/m (0.7% consensus). However, March’s reading was revised lower to 0% from +0.1% first estimate. Core personal expenditure (Core PCE), the Fed’s favourite measure of The Chicago purchasing manager index, printed below the 50 threshold, which separates expansion from contraction, at 49.3 for May, down from 50.4 in April. Finally, The Dallas manufacturing activity index came in at -20.8 from -13.9 in April. All in all, we believe that the US economy is still too fragile to take the risk to increase rates by another notch. The manufacturing sector in the doldrums, while inflationary pressure struggles to exhibit strong momentum. Therefore we expect the Fed to make a move before at least the end of the summer, which implies that risk is on the upside in EUR/USD. The 1.1096 - 1.1098 will act as support (200dma and low from May 30th).

USD/JPY was the worst performer among the G10 complex with a drop of 0.70% after Prime Minister Shinzo Abe declared he will delay an increase of the sales tax until 2019 in order to achieve strong growth. The decision, however, will put Japan’s credit rating at risk as the decision will definitely not help the government to bring the budget balance back in the black. USD/JPY fell to 109.80 on speculation that the decision will boost consumer spending and prevent suffocating the economy.

In Australia, the Aussie jumped 0.45% against the greenback after data showed the economy grew 3.1%y/y in the first quarter of 2016, the fastest pace since the fourth quarter of 2012. On a month-over-month basis, the gross national product rose 1.1% (s.a.), after increasing 0.7% in the previous one. The expansion is mostly due to a surge in exports and to some extend to an improvement in household spending. However, with most commodity prices adjusting to the downside - especially iron ore prices, which collapsed more than 30% since the beginning of the year - we expect the economy to experience a rougher second quarter.

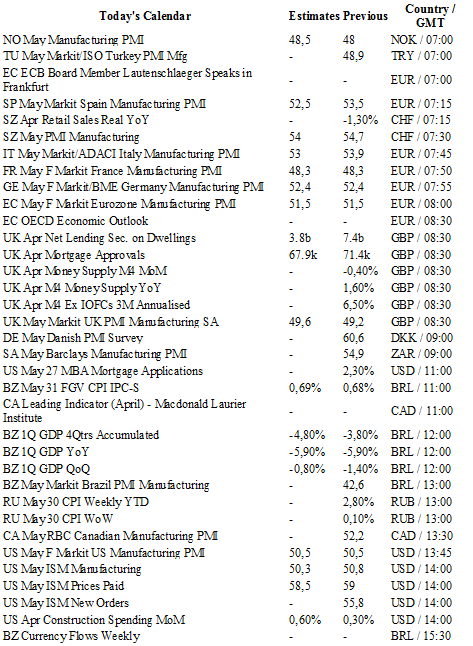

Today traders will be watching manufacturing PMI from Norway, Turkey, Spain, Switzerland, Italy, France, Germany, Denmark, the UK, Brazil, the US and Canada; GDP and trade balance from Brazil; MBA mortgage application, Beige Book and construction spending from the US.

Currency Tech

EUR/USD

R 2: 1.1349

R 1: 1.1243

CURRENT: 1.1128

S 1: 1.1058

S 2: 1.0822

GBP/USD

R 2: 1.4969

R 1: 1.4770

CURRENT: 1.4471

S 1: 1.4404

S 2: 1.4300

USD/JPY

R 2: 113.80

R 1: 111.91

CURRENT: 110.00

S 1: 108.23

S 2: 106.25

USD/CHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9937

S 1: 0.9872

S 2: 0.9751