The USD/CHF has been able to clear the initial resistance of 0.9780, achieving a daily closing above it.

Although RSI is moving near overbought levels, ADX still remains strongly positive.

We remain bullish on the USD/CHF pair, while another break above 0.9850 will accelerate the upside wave, reinforced by the stronger positive signals over bigger time frames.

Support: 0.9780-0.9760-0.9720

Resistance: 0.9850-0.9905-0.9945

Direction: Bullish

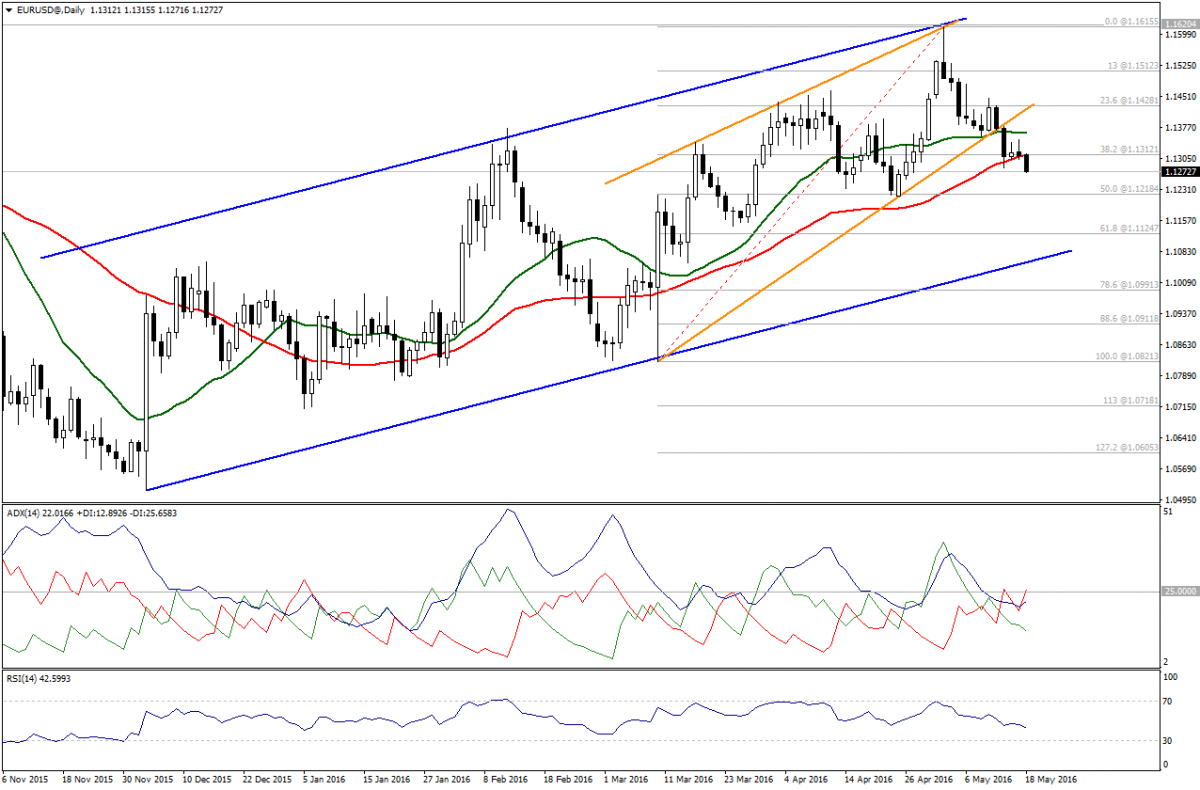

EUR/USD stabilized below 1.1315 and below SMA20, which may assist bears to dominate the market.

On the downside, coming below 1.1220-1.1215 will accelerate towards 1.1125, while ADX shows increase in bulls’ power.

RSI trades below 50.00, so only a break above 1.1430 will negate, but for now we are bearish.

Support: : 1.1220 – 1.1170 – 1.1125

Resistance: 1.1285 –1.1315 – 1.1365

Direction: Bearish

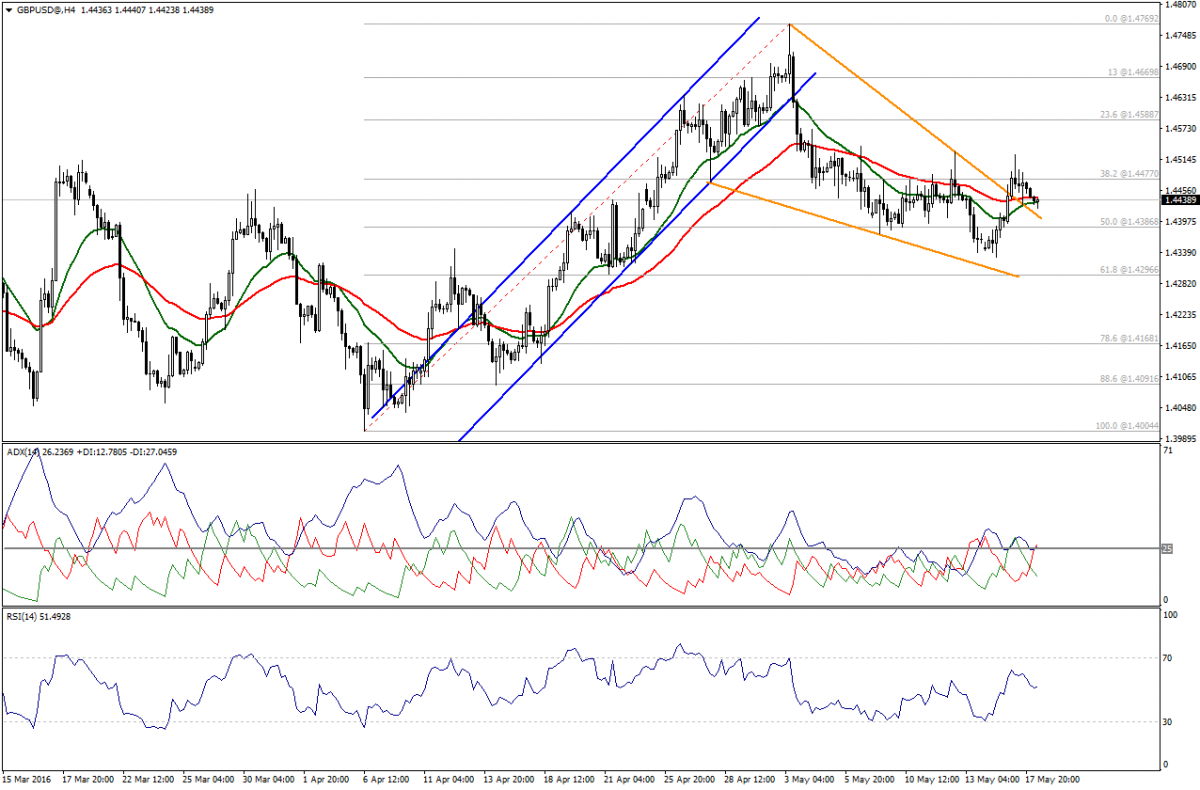

After failing to stabilize above 1.4475-1.4480, GBP/USD has moved lower below SMA20 and SMA50. Moving between the aforesaid resistance and 1.4385 is neutral.

There is a sign of negativity on ADX, but RSI stabilizes below 50.00 areas.

Hence, neutrality is favored as far as 1.4480 and 1.4380 hold.

Support: 1.4420 – 1.4385 – 1.4295

Resistance: 1.4480 – 1.4525 – 1.4590

Direction: Neutral

USD/JPY fluctuated strongly yesterday and during the Asian session, but is still moving above SMA20 at 108.30, while RSI and ADX remain positive.

From here we will be bullish, aiming to see the pair clearing the cluster resistance of 109.40 followed by the stronger one at 109.60.

Support: 108.60-108.30-107.90

Resistance:109.40-109.60-110.00

Direction: Bullish