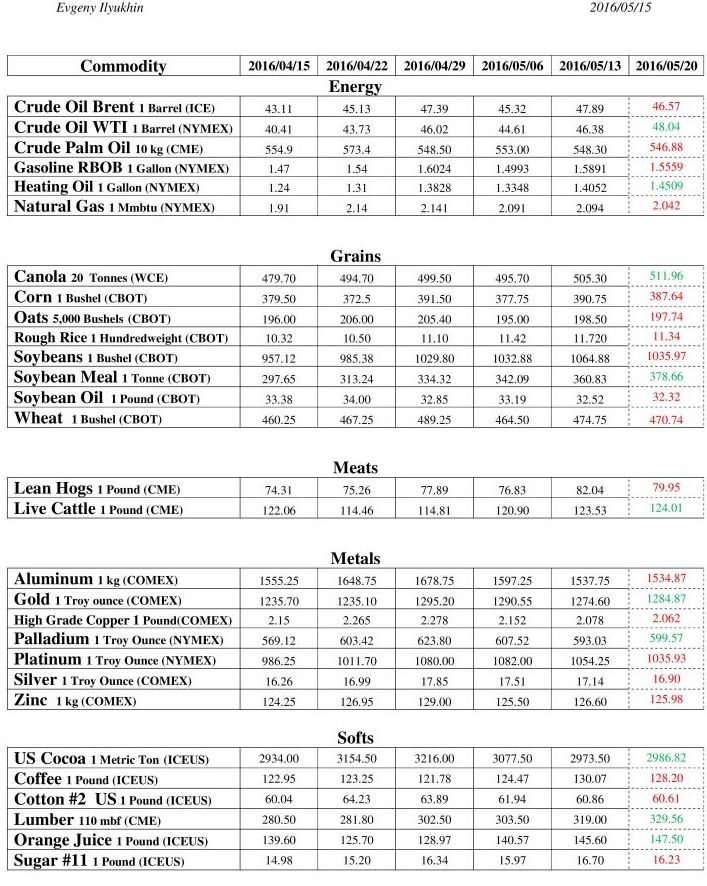

This article aims to provide price forecasts for commodity futures for May 20, 2016. The table below shows the weekly commodity futures prices in US dollars over the period from April 15, 2016 to May 13, 2016 (commodity exchanges data) and forecasted period - May 20, 2016 (author’s calculations).

The commodities are classified and placed in alphabetical order. The commodity metrics and names of exchanges are provided.

Forecasted values: increase in green; decrease in red. Forecasts are projected with an Autoregressive Integrated Moving Average (ARIMA) model based on relevant weekly historical data. It is advised to use forecasted values for identifying the short-term price trends over the period firstly.

The notable positive changes are expected for Soybean Meal (4.94%), WTI Crude Oil (3.58%), Lumber (3.31%) and Heating Oil (3.25%).

Rough Rice (-3.24%), Soybeans (-2.71) will likely close in “red” on May 20, 2016.

On the group level, only Softs commodities (0.07%) are expected to grow a bit by the end of the next week.

Notice that Brent Crude Oil and WTI Crude Oil have different price trends despite of high correlation ratio (0.97).