Marketing company Meat & Livestock Australia forecasts the cattle inventory in Australia to contract to 26.2mln heads until June 30 and to 25.9mln heads until 2017. In such a case the cattle inventory is to fall by 3.4mln heads, or by 12%, since 2013 to the lowest in 24 years. Will the beef rise in price?

Besides Australia, another growth factor for beef may be the monthly USDA report released on Friday. The January placements in US feedlots fell 1% to 1779 heads compared to the last year’s level. Early February 2016, the cattle inventory in feedlots amounted to 10.709mln heads, while last year the number was 10.713mln. This January, 2% fewer cows were sold compared to 2015. Their total number was 1.589mln, which is the lowest since 1996.

The beef of local production rose in price 7.3% last year, the record growth since 2010 when the prices surged 10.5%, according to Statistics Korea. The Korean meat became 14% dearer in January year on year. The average cost of livestock products in South Korea rose in 2015 by 3.7% outpacing inflation (0.7%) by far.

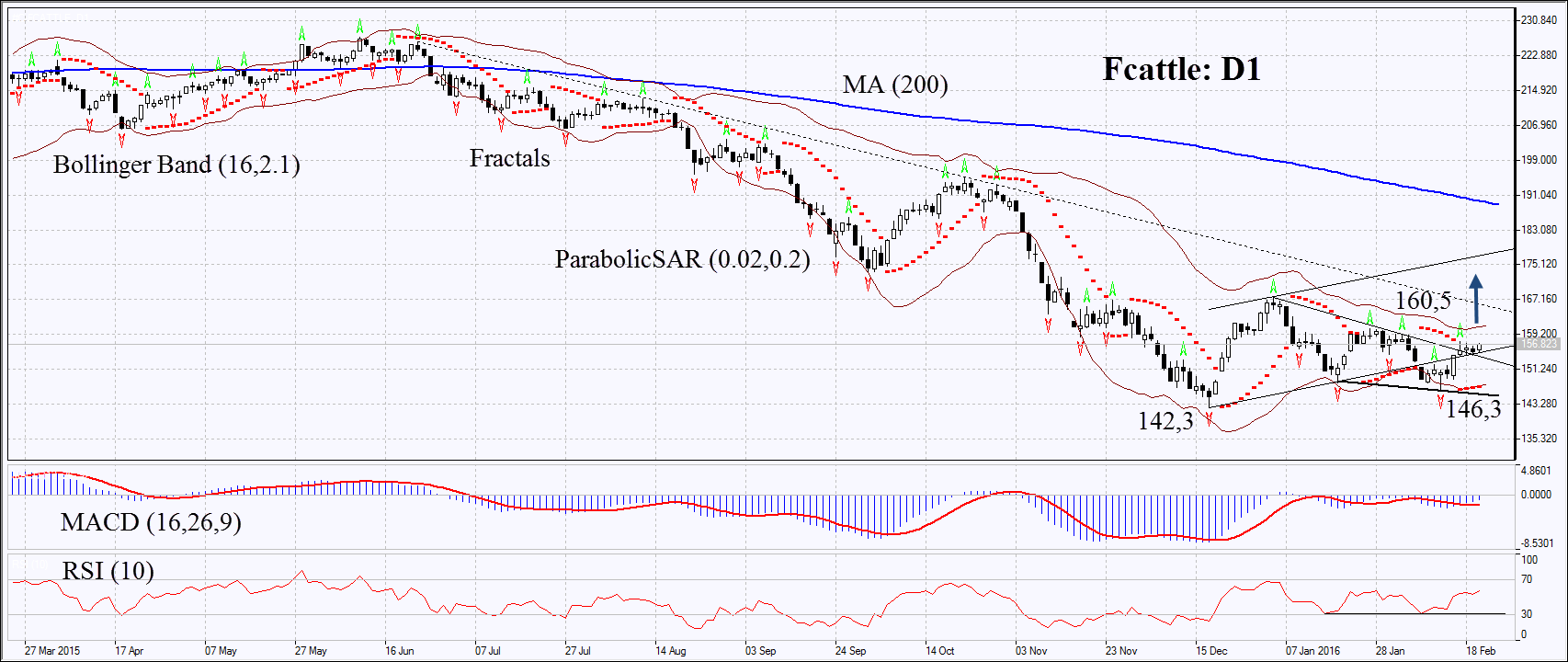

On the daily chart, Fcattle: D1 hit a fresh 2-year low last December and is correcting within the sideways channel now. The Parabolic and MACD indicators have formed the buy signals. RSI is rising and has surpassed the level of 50 but failed to reach the overbought zone. It has formed the positive divergence. The Bollinger bands have contracted a lot, which means low volatility.

The bullish momentum may develop in case the beef surpasses the three last fractal highs, the Bollinger band and the Parabolic signal at 160.5. This level may serve the point of entry. The initial risk-limit may be placed below the Parabolic signal, Bollinger band and the last fractal low at 146.3 The most risk-averse traders may place it below the 2-year low at 142.3.

Having opened the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point.

The most risk-averse traders may switch to the 4-hour chart after the trade and place a stop-loss there, moving it in the direction of the trade. If the price meets the stop-loss level at 146.3 or 142.3 without reaching the order at 160.5, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position: Buy

Buy stop: Above 160.5

Stop loss: Below 146.3 or 142.3