Daily Technical Analysis on EUR/USD: EUR/USD" title="EUR/USD" width="500" height="340">

EUR/USD" title="EUR/USD" width="500" height="340">

January 12, 2012

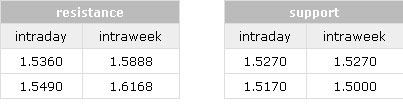

Current level - 1.2723

The outlook on the senior frames remains bearish within the downtrend from 1.4250 with an initial resistance at 1.2860-80 and crucial level at 1.3080. The intraday bias is also negative below 1.2730 for a break through 1.2665 low, which should clear the way for 1.2430. An eventual break above 1.2730 has no crucial importance and will only state, that the corrective pattern above 1.2665 is still on th run for a tighter test of 1.2850.

Daily Technical Analysis on USD/JPY:

USD/JPY" title="USD/JPY" width="500" height="340">

USD/JPY" title="USD/JPY" width="500" height="340">January 12, 2012

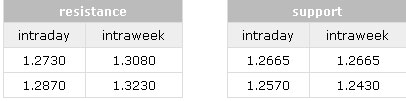

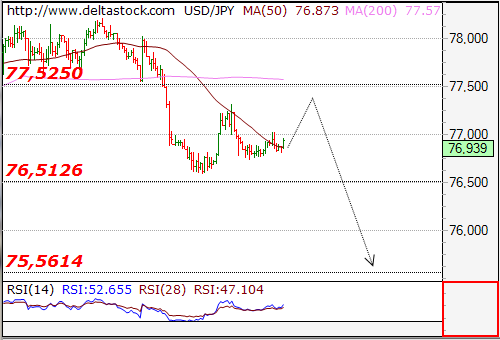

Current level - 76.93

The pair is still in the broad range above 76.50 and the intraday outlook is slightly bullish for a second test of 77.35-50 resistance area. Due to the corrective inner structure of th rebound above 76.50, a break through that level is to be expected, for a slide towards 75.56 low.

Daily Technical Analysis on GBP/USD:

GBP/USD" title="GBP/USD" width="500" height="340">

GBP/USD" title="GBP/USD" width="500" height="340">January 12, 2012

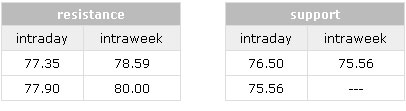

Current level - 1.5299

Yesterday's sell-off broke through 1.5360 support area and is currently testing 1.5270 low. The outlook is undoubtedly bearish for a break through 1.5270, en route to 1.50+ sentiment zone. Initial resistance is projected at 1.5360 and a violation of that area will switch the bias to neutral, but only a break above 1.5490 will confirm an unsuccessful test of 1.5270 support.