'Tis the season for making forecasts -- all because of the calendar. It is an opportunity to look foolish, or to gain edge. This article will illustrate both. Here are the ways to go wrong:

- Opine about subjects where you have no edge

- Pick a time frame unsuited to your methods

- Fail to admit the range of uncertainty

There is annual fun where we can (correctly) criticize the forecasters. Here are some excellent takes on the subject:

- Abnormal Returns, explaining why the "top ten" lists are silly

- Barry Ritholtz, citing a bunch of predictions that did not work out, and warning about more of the same

I find myself agreeing with nearly every point made in these articles. Having said this, the overall conclusion feels a bit wrong. You cannot avoid making forecasts.

Everyone makes forecasts. Everyone.

You do it through your decisions -- every day.

Anyone managing money makes decisions about asset allocation, asset choices, and the evaluation of risk. Your trading and investment decisions reflect your forecasts.

If you are a real player -- investment manager or pundit -- you cannot escape this by criticizing everyone else. Your actions define what you really stand for.

For example....

If you are an individual investor who has chosen to be out of the market, you are making an important forecast. You believe that every investment opportunity will lose money for your and/or you know when to re-enter. If you are following some pundit who does not reveal his own record, you are allowing someone to substitute anecdotes for data. Good luck with that!

As one who both makes forecasts and embraces those of various experts, I look for those who really know about a particular subject and have a proven track record. I chuckle at those who think they know how the presidential election will turn out. I know about this subject and I have great sources, but it is a guess -- as is the market implication.

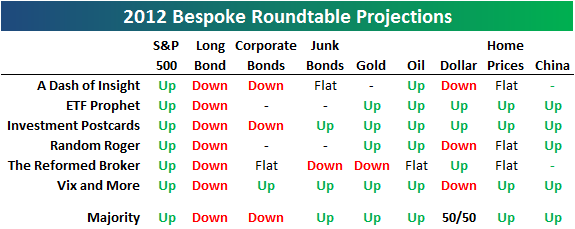

But you get the idea. The real value of the Bespoke Roundtable is the quality of the questions and the nuance in the answers. Some responding colleagues (wisely) chose not to answer some or all questions.

I view the result as much more valuable than the average "year ahead" look.

Here is the summary of forecasts from The Bespoke Investment Group Roundtable

The panel is really great -- all sources that I regularly read and depend upon to inform my decisions. I suggest that you set aside a little time to read all of the responses. Here is the list of participants, with links to their answers: