The “Santa rally” finally got going yesterday as better than expected news from the Eurozone gave risky assets a bump higher ahead of an important day for Europe and its banking sector. German IFO business confidence rallied to 107.2 yesterday, the 2nd unexpected rise in two months, after it became clear that German businesses are expecting that the worst of the debt crisis is likely over and that growth will return to Europe in 2012. Businesses reported that order books were still operating at good levels and that despite a fall off in business with other countries in the Eurozone, the slack has been taken up by the US and buyers in the Far East.

Equities rallied yesterday by anywhere between 1 and 4 per cent and the euro managed to push around 80bps higher versus the USD. It has however stayed close to 10 month lows against the pound despite that IFO figure and a corking auction out of Spain.

Spain managed to get away over EUR5bn of short-term debt more than they originally wanted to such was the demand for short-term paper with the yield on 6 month money falling from 5.227% at a previous auction, to 2.435% yesterday. That is a massive shift however, unfortunately, it has very little to do with the Spanish economy and more to do with the ECB’s massive Long-Term Refinancing Operation that is due today.

The European Central Bank will today offer unlimited three-year loans to banks at a rate of 1% in order to try and recapitalise balance sheets and take part in a profitable carry trade. The thought is that banks will borrow oney from the ECB at a cheap rate and invest that in peripheral debt which are paying relatively large interest rates. The bank of course pockets the difference and this is the reason why we have seen the yields on shorter term Italian and Spanish debts fall back in recent weeks.

There are risks to this plan however as although the banks are urged to take up this “free money” and invest it in to sovereign debt there is no compunction for them to do so. It is also true that the fact that there is increased bank funding does not mean that the sustainability of European sovereigns is in any way altered for the better. You also have to ponder how prepared banks will be to add to an already toxic portfolio, ahead of possible ratings downgrades, if other members of the banking fraternity are not compelled to do so. Anyway, banks are expected to take up around EUR300bn between them from the ECB when the results are released at 10.15 GMT.

As we said above, GBP has managed to keep its head up despite some negative headlines. The GFK consumer confidence number diverged from its Nationwide counterpart overnight as it fell to its lowest level since early 2009. The reasons behind the fall are not difficult to guess; fears over the Eurozone and its effects on the UK economy plus unemployment concerns seem to be the major causes. We also heard from Moody’s overnight (it wouldn’t be a morning update without a little bit from a ratings agency) who warned Britain that our AAA rating is at risk from rising debt levels and the euro crisis. This is not something we didn’t already know but I’m sure I heard a small cheer from across the Channel when it was released.

All eyes will be on that LTRO from the ECB at 10.15 GMT today and will drive flows higher we expect. We also have Italian GDP at 09.00 and minutes from the latest Bank of England meeting at 09.30.

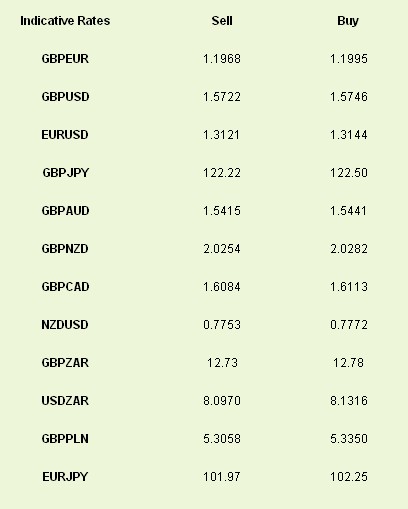

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Banks Queue up for ECB Cash

Published 12/21/2011, 08:58 AM

Updated 07/09/2023, 06:31 AM

Banks Queue up for ECB Cash

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.