European markets remained under pressure yesterday with continental bourses all losing ground yesterday while the euro stayed under pressure. News on the political front was sparse but Mario Monti has said that he will meet with President Napolitano to announce his cabinet today. As we highlighted on Monday, the longer that the political situation goes unresolved the more risk it holds of pulling the euro lower. There were rumours yesterday that Monti is looking to serve until the end of 2013 although some politicians are said to be increasingly annoyed at the appointment of a technocrat with no political experience over a long-time politician.

The on-going fears surrounding debt levels and the resolution of their imbalances saw peripheral bond yields remain high versus that of Germany and non-European AAA rated countries. Pressures have been seen in Portugal, Spain, France, Belgium and Austria in the past 24hrs.

The 2 speed global recovery was evident yesterday with advance retail sales in the United States exceeding the consensus forecast of 0.3% to post an increase of 0.5%. Sales in 7 of the 13 categories were said to be faster with electronics the leader. We would suspect that this is as a result of the release of the new iPhone. Even so, we have started to see the data from the US improve markedly in the past month while releases from other developed nations have remained weak. Like it or not, the global economy rests on the consumption of the average American and we need them to pick it up some in the coming months.

Eurozone GDP rose at a steady pace of 0.2% in Q3, in line with the consensus forecast, but there were pockets of failing strength. While German growth accelerated to 0.5% from 0.3% we saw French GDP rise 0.4% in Q3 but the Q2 figure was revised down to -0.1% from a stagnant 0% originally. Figures from Spain and Belgium were also flat while the Netherlands slipped -0.3% and Portugal by -0.4% and Greece’s was a horrific 5.2% lower from this point last year. Italy have not released their numbers yet. I’m sure there’s a joke there.

The most closely watched event today will be the Bank of England’s Quarterly Inflation Report. CPI in the UK fell yesterday to 5.0% from 5.2% in September. This will trigger another round of letters between Mervyn King and Chancellor George Osborne in which the former will state the reasons why inflation in the UK has been above the Bank’s 2% target for the past 23 months. We are in agreement with the BOE that inflation will be tamed over the course of the next year, as certain extraordinary items fall out of the year-on-year figures. The main cause of price increases in the UK over the past 12 months was the 2.5% increase in VAT, introduced in January. The weak pound won’t have helped either. This means only one thing in our eyes; further quantitative easing past February (when the latest injection of £75bn is expected to run out).

We expect the meeting to be a net negative for the pound as Mervyn King has a habit of talking down sterling when he gets in front of a microphone and while questions will be about the UK economy he will be keen to emphasise that the problems in the EU have direct effect on the UK. For that reason I think he will tip his hand towards further QE in the UK if we do not see a pickup in the fortunes of the developed world through Q4.

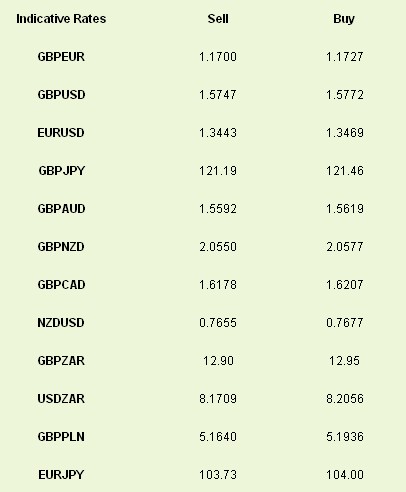

Latest

exchange rates at time of writing

The on-going fears surrounding debt levels and the resolution of their imbalances saw peripheral bond yields remain high versus that of Germany and non-European AAA rated countries. Pressures have been seen in Portugal, Spain, France, Belgium and Austria in the past 24hrs.

The 2 speed global recovery was evident yesterday with advance retail sales in the United States exceeding the consensus forecast of 0.3% to post an increase of 0.5%. Sales in 7 of the 13 categories were said to be faster with electronics the leader. We would suspect that this is as a result of the release of the new iPhone. Even so, we have started to see the data from the US improve markedly in the past month while releases from other developed nations have remained weak. Like it or not, the global economy rests on the consumption of the average American and we need them to pick it up some in the coming months.

Eurozone GDP rose at a steady pace of 0.2% in Q3, in line with the consensus forecast, but there were pockets of failing strength. While German growth accelerated to 0.5% from 0.3% we saw French GDP rise 0.4% in Q3 but the Q2 figure was revised down to -0.1% from a stagnant 0% originally. Figures from Spain and Belgium were also flat while the Netherlands slipped -0.3% and Portugal by -0.4% and Greece’s was a horrific 5.2% lower from this point last year. Italy have not released their numbers yet. I’m sure there’s a joke there.

The most closely watched event today will be the Bank of England’s Quarterly Inflation Report. CPI in the UK fell yesterday to 5.0% from 5.2% in September. This will trigger another round of letters between Mervyn King and Chancellor George Osborne in which the former will state the reasons why inflation in the UK has been above the Bank’s 2% target for the past 23 months. We are in agreement with the BOE that inflation will be tamed over the course of the next year, as certain extraordinary items fall out of the year-on-year figures. The main cause of price increases in the UK over the past 12 months was the 2.5% increase in VAT, introduced in January. The weak pound won’t have helped either. This means only one thing in our eyes; further quantitative easing past February (when the latest injection of £75bn is expected to run out).

We expect the meeting to be a net negative for the pound as Mervyn King has a habit of talking down sterling when he gets in front of a microphone and while questions will be about the UK economy he will be keen to emphasise that the problems in the EU have direct effect on the UK. For that reason I think he will tip his hand towards further QE in the UK if we do not see a pickup in the fortunes of the developed world through Q4.

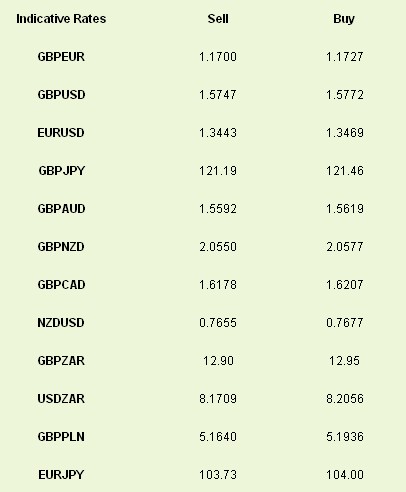

Latest

exchange rates at time of writing