For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1177.

In economic news, the Euro-zone’s seasonally adjusted current account surplus narrowed to a level of €21.0 billion in July, following a revised current account surplus of €29.5 billion in the prior month. On the other hand, the region’s seasonally adjusted construction output rose by 1.8% on a monthly basis in July, notching its highest level since January 2016, compared to a revised rise of 0.3% in the previous month.

Macroeconomic data released in the US indicated that the NAHB housing market index advanced more-than-expected to a level of 65.0 in September, rising to its highest level since October 2015. Markets expected the index to advance to a level of 60.0, compared to a revised reading of 59.0 in the prior month.

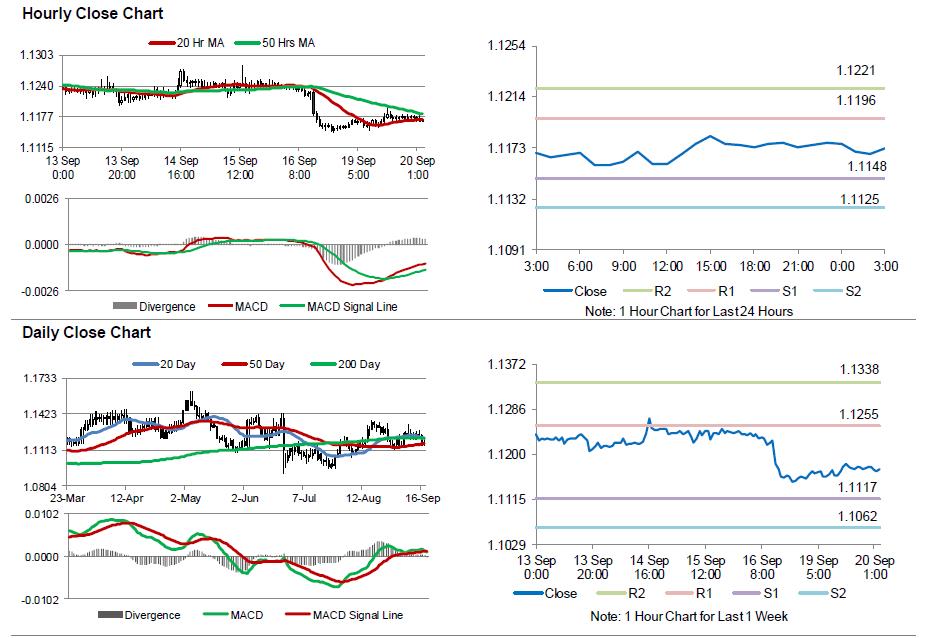

In the Asian session, at GMT0300, the pair is trading at 1.1172, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1148, and a fall through could take it to the next support level of 1.1125. The pair is expected to find its first resistance at 1.1196, and a rise through could take it to the next resistance level of 1.1221.

Going ahead, market participants would await the release of the US housing starts and building permits data, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.