During FY16 Windar Photonics (LON:WPHO) took some important strategic steps in rolling out its innovative LiDAR: implementing additional functionality to enlarge the addressable market and modifying its sales channels to focus on the IPP market. While y-o-y revenue growth of 26% was lower than management guidance, the results show substantial reductions in the cost-base and lower losses.

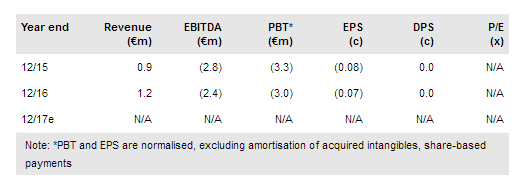

Management note that recent order wins are likely to result in high double digit revenue growth during H117 and the company approaching EBITDA breakeven. We are withdrawing our estimates and valuation until the interims when there should be more clarity on test programmes converting to sales.

Management undertook a thorough review of operations during H216, switching from reliance on a direct sales force to non-exclusive regional distributors (currently 15 worldwide) who have strong relationships with local IPPs (Independent Power Producers). As a result, EBIT losses reduced by 39% y-o-y during H216, while in H116 they widened by 37%. The change in sales channel resulted in revenues from Asia almost doubling during FY16 and a more recent improvement in performance in Europe and North America. Key technology advances included starting a two-year programme funded by the EU for wake detection. This has already attracted several prestigious OEM partners.

FY16 free cash outflow totalled €2.0m (€0.7m H216). Windar raised £1.9m (€2.3m) gross in three placings, leaving the company with €0.8m net cash at end FY16.

To read the entire report please click on the pdf file below: