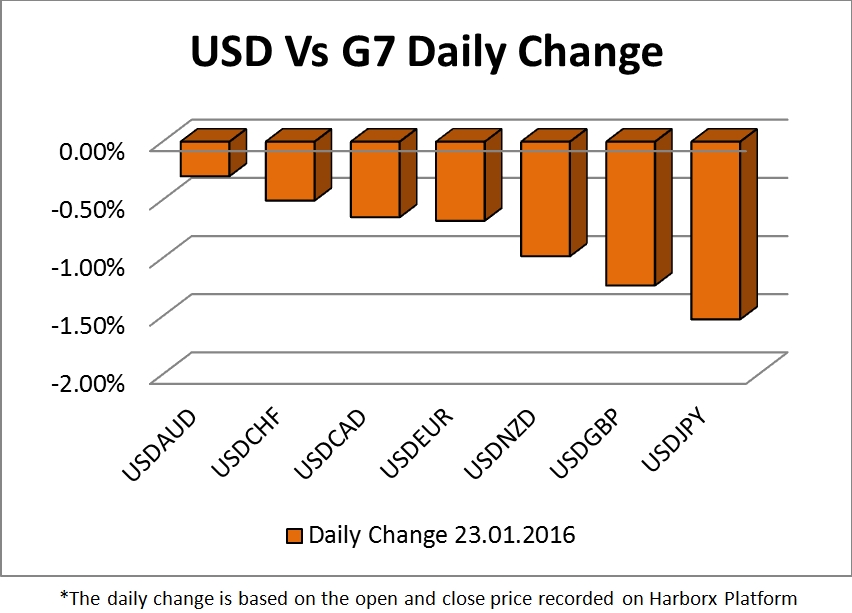

The US dollar closed lower against all of its major counterparties on Monday, with the big winner of the day being the Japanese Yen as the Gopher dropped by 1.5% against the greenback. Since the beginning of 2017, the US dollar follows a declining pattern, losing some of its “Trumpolitics” strength. In the morning, the new president gave some bullish momentum to the US dollar when he announced his plans of a massive tax cut. However, it did not take long for the traders to drop the dollar back to its near-term downtrend as it is obvious that the balance within taxes and government spending will be covered by President’s plan to impose a major border tax. Furthermore, the US President formally removed the country from the Trans-Pacific Partnership trade agreement yesterday and he is ready to negotiate with NAFTA. The fiscal plans of Mr. Donald Trump would increase the US exports and the inflation, at the time of nearly full employment and inflation near the Fed’s targets. While Mr Trump’s thoughts on ”making America great again” are great for the US, the timing is likely wrong. Mr Trump pulls the trigger for a trade war among US and the rest of the world. The main reason for the falling dollar recently is uncertainty about the plans of the new government, but the fiscal package that the President reveals slowly would actually help the Dollar appreciate as soon as the border tax increase and the tax income decrease. In the long term though, if the plans are not implemented carefully, the US economy could face overheating and complete the economic cycle.

The UK Supreme Court ruled today that government’s triggering of the Article 50 requires the parliamentary vote consent, with the majority of 8 out of 11 court members against the government. Moreover, the Court announced today that the UK doesn’t need to consult Scotland on Brexit and Theresa May must present Brexit Bill. The Cable fell by around 90 pips reaching the level of 1.2435 as an immediate reaction to the Court’s rules while EUR/GBP raised by 70 pips touching the level of 0.863. The next economic events that would determine Pound’s direction this week is the quarterly GDP release for Q4 2016 on Thursday’s European morning and of course the PM’s meeting with the new US President on Friday.

As for the rest of the economic calendar, today we are looking for the US Existing Home Sales data release at 15:00 GMT which is expected lower than the last month while on Wednesday’s Asian morning the Australian CPI is going to be released with expectations laying at 0.7%.

Technical View

EUR/USD

The world’s most traded currency pair is still trading within the rising channel and has created a new high at 1.077. MACD and RSI are both lying on their bullish territories while they are both slopping down. On the other hand, ADX weakens indicating no clear direction on the near-term and short-term chart. The overall sentiment is still bullish, but we consider the price level of 1.08 a critical level for the pair and the buyers which may have significant amounts of trading volume taking profit somewhere near. The major support levels are near 1.07 and 1.065 while the major resistances lie around 1.077 and 1.08.

GBP/USD

The Cable raised by more than 400 pips since the beginning of the last week and it is still moving above its uptrend line and the triple SMAs. However, ADX indicates short-term negative direction while MACD and RSI are slopping down to test their equilibrium levels. The support of 1.242 which coincides with SMA50 is a strong level on the 1-hour timeframe while the second valid support lies near SMA100. The key point is that the strongest trend indicator, the price, is still supportive of the uptrend and it goes in line with the recent fundamentals. We see a possible test of SMA50 and then a retun back to the main uptrend. The significant resistance levels are near 1.25 and 1.254.

USD/CHF

The bearish suggested target was met and the pair is recovering at the time of writing. Following the pattern of the last few days on the H4 chart, the pair is likely to correct upwards up to the SMAs and then continue its major downtrend. Both the MACD and RSI are on bearish territories; however they are both slopping upwards indicating bullish correction before further dropping. Another sign of the non-clear direction is the level of the Average Directional Index which is on neutral territories. The major resistance is of course the parity level at 1.0 and then 1.005 while the main support levels are near 0.995 and 0.99.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.