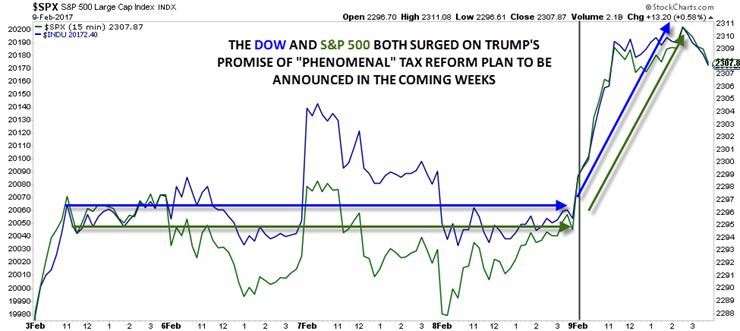

With just a few grandiose words, President Trump was able to reinvigorate the struggling "Trump Trade," driving major US equities to record highs and boosting the buck.

In a meeting with airline executives on Thursday the President said, "We're going to be announcing something I would say over the next two or three weeks that will be phenomenal in terms of tax and developing our aviation infrastructure." His press secretary then went on to reiterate the substance of the message, telling press to expect "a comprehensive plan, something we haven't seen since 1986 ... It's going to recognize the need to give so many working Americans the relief that they need. What he wants to do is create a tax climate that not only keeps jobs here but incentivizes companies to want to come here, to grow here, to create jobs here, to bring their profits back here."

Prior to Wednesday's announcement, investors were showing their concern with the new President's priorities. As we've noted over the last couple of weeks (see "Trumpflation" is still thriving, but 'Trumphoria' is fading away" and "How to know if the 'Trump Rally' is running out of brea(d)th" for more), the new administration's focus on controversial trade and immigration policies threatened to use up the limited "political capital" of the historically unpopular president. With this week's pivot to fiscal issues, traders were enthusiastic that "The Businessman President" was getting back to economic issues.

Source: Stockcharts.com

Tax reform is an issue that, at least in principle, has bipartisan support but the details are more murky. Despite Trump's promises to "Drain the Swamp," there is still an army of lobbyists that will fight tooth and nail to defend niche carve-outs and benefits within the tax code.

Trump's words are like a hungover post New-Year's Eve reveler making a resolution to finally get in physical shape this year. The promise is the easy part; the hard part is getting out of bed early to go the gym on a cold day in February, or in this case, patiently navigating the countless, fiercely-defended corners of the 75,000 page tax code.

That said, Trump's comments have reignited the market's animal spirits once again and over the next few weeks, we wouldn't be surprised to see a "honeymoon period" where investors can interpret the President's vague vow however they wish. Once the framework of the plan hits the wires and the enormity of the reform process sinks in, there's risk that traders will be disappointed that what they see doesn't live up to their lofty expectations.