GBP/USD extended the bullish momentum for the third consecutive session taking advantage of tripping US dollar yesterday. US dollar opened yesterday with a strong tone with an upward gap, then rallied further more with a 101.60 high but failed to withhold strong gains as the US index plunged to 101.22 today in early morning sessions. GBP/USD clocked a high today at 1.2508, struggling to hold the 1.25 level as the pair trades 1.2501 intraday.

Yesterday, analysts at Scotiabank mentioned that the UK public sector net borrowing data showed a surplus of 9.4B Pound in January, the largest for the month since at least 2001. BOE Gov. Carney crossed wires yesterday stressing that last week's CPI 1.8% overpass was justified by a weaker GBP and that wages were key to how much tolerance the BoE had for above target inflation. The governor cautioned that the BoE had perhaps been “over-predicting” wage growth, which suggests no rush to react to the inflation push...

GBP Fundamentals

1- Second Estimate GDP q/q at 9:30 AM GMT.

USD Fundamentals

1- FOMC meeting minutes tonight at 7:00 PM GMT

2- Unemployment claims tomorrow at 1:30 PM GMT.

Technical levels to watch :

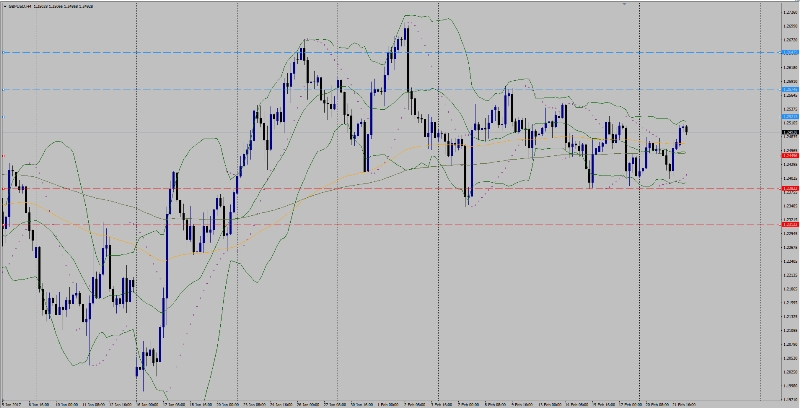

Trend: Bullish Sideways

Daily Pp: 1.2451

Resistance levels: R1 1.2521, R2 1.2574, R3 1.2647

Support levels: S1 1.2445, S2 1.2382, S3 1.2312

Remark: look forward for UK GDP today. Also FOMC meeting tonight and US data tomorrow will decide USD levels. A penetration for S1 level is a negative sign for the cable with increase of additional selloffs and wash towards S2 level. Closing above R1 level will confirm the bullish momentum and spark additional attacks toward R2&R3 levels.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.