Reading Time: 2 minutes

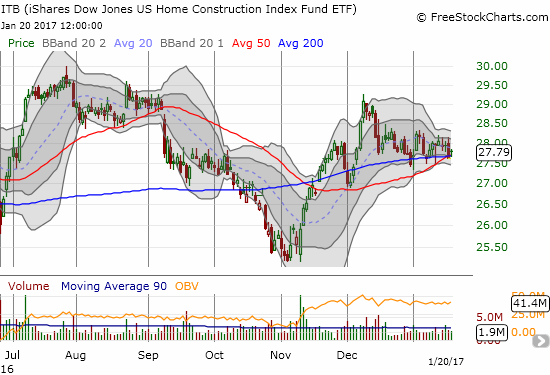

On January 9, 2017, the Federal Housing Authority (FHA), run by the Department of Housing and Urban Development (HUD), announced a cut in the premium homebuyers pay for mortgage insurance. This policy change has the distinction of being one of the first, if not THE first, reversals of the post-Obama era (the L.A. Times reported the change occurred an hour after President Donald Trump officially took office). The premium cut was scheduled to take effect on January 27th, but the announcement did not seem to impact the iShares US Home Construction (ITB). So, I do not expect the reversal of the cut to impact ITB. However, ITB IS at a critical juncture as it sits right on top of converged support from its 50 and 200-day moving averages (DMAs).

The iShares US Home Construction (NYSE:ITB) last topped out on December 8th, 2016 and has ground to a halt for over a month on low trading volume.

While ITB will not shudder one way or the other, the financial impacts to borrowers are real. For example, in its appeal to the Trump administration to reinstate the insurance cut, the California Association of Realtors (CAR) estimated that the average Californian borrower would have saved $860 per year. California has the nation’s most expensive real estate market, so of course the impact would have made the most difference there.

For its part, HUD explained the change in policy as one of financial prudence:

“FHA is committed to ensuring its mortgage insurance programs remains viable and effective in the long term for all parties involved, especially our taxpayers. As such, more analysis and research are deemed necessary to assess future adjustments while also considering potential market conditions in an ever-changing global economy that could impact our efforts.”

Compare this to the rationale the FHA gave earlier for instituting the cut:

Background on the cut in the rate for mortgage insurance.

The FHA previously concluded that its reserves and the housing market were both healthy enough to warrant a cut in the insurance premium. Now, the FHA will, presumably, do more analysis on this assessment. Regardless, the message to housing investors is that the market is not likely to get any near-term boosts from policy-making.

(See the L.A. Times article “HUD suspends FHA mortgage insurance rate cut an hour after Trump takes office” for more details and background on the FHA mortgage insurance policy. Note that Dr. Ben Carson’s appointment to head HUD has not yet been confirmed by Congress.)

Be careful out there!

Full disclosure: long ITB call options