After announcing 2Q16 earnings, Southwest Airlines (NYSE:LUV) fell nearly 12%, as investors seemed to care more about Southwest’s ability to hit analyst expectations, which have inherent flaws, and less about the company’s record profits.

Investors are overlooking the fact that the company’s lowered revenue guidance was already priced into the stock’s valuation, as we’ll show below. We believe this decline is an overreaction and creates a great buying opportunity, which we saw before the stock’s decline when we made LUV our Long Idea of the Week and included it in our Model Portfolio: Linking Exec Comp to ROIC

Guidance Remains Well Above Market Expectations For Cash Flows

Profits are growing strongly just as they have been for decades. The problem, at least for short-term investors, was guidance that unit revenues would fall 3-4% while costs were increasing about 1%.

Those numbers are a drop in the bucket compared to the cash flow declines already baked into the current stock price. At its current price of $38/share, LUV has a price-to-economic book value (PEBV) ratio of 0.7. This ratio implies that the market expects LUV’s profits to permanently decline by 30%.

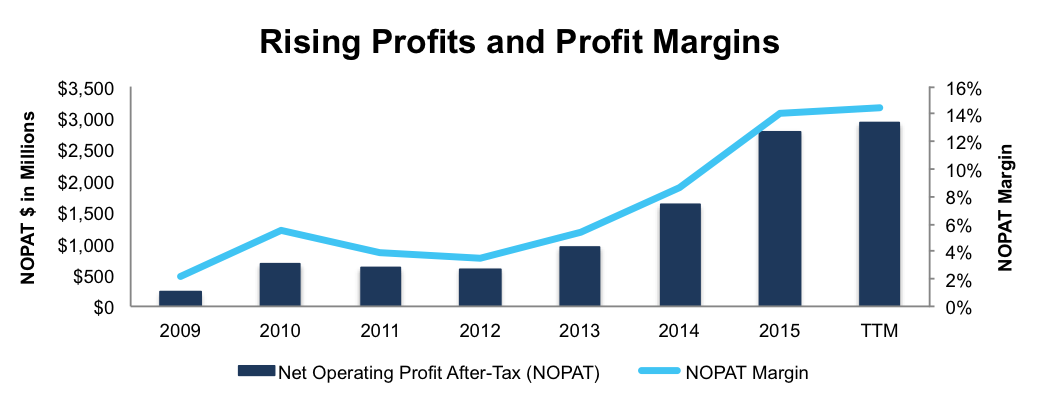

As we noted in our Long Idea of the Week report, since 2009, Southwest’s after-tax profit (NOPAT) has grown by 52% compounded annually. Figure 1 has details. The stock is even more attractive today as expectations for future cash flows are lower now.

Even if the conditions that caused the lowered guidance persist, we think it is safe to say that Southwest will do better than a permanent 30% decline in profits over its remaining life.

If Southwest can grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $66/share today – a 74% upside. Couple in Southwest’s share repurchase activity and the company’s dividend (which could yield upwards of 6%) and its easy to see why now may be the time to take a look at LUV.

Figure 1: Southwest’s Increasing Profits and Profitability

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.