The pair keeps forming a consolidation “wedge” pattern. There is a chance of upward rebound from its lower border.

On the daily chart, the pair is trading just above the lower line of Bollinger Bands®. The price remains below its moving averages that are directed down. The RSI is falling and approaching the oversold zone. The composite is trying to turn down as well.

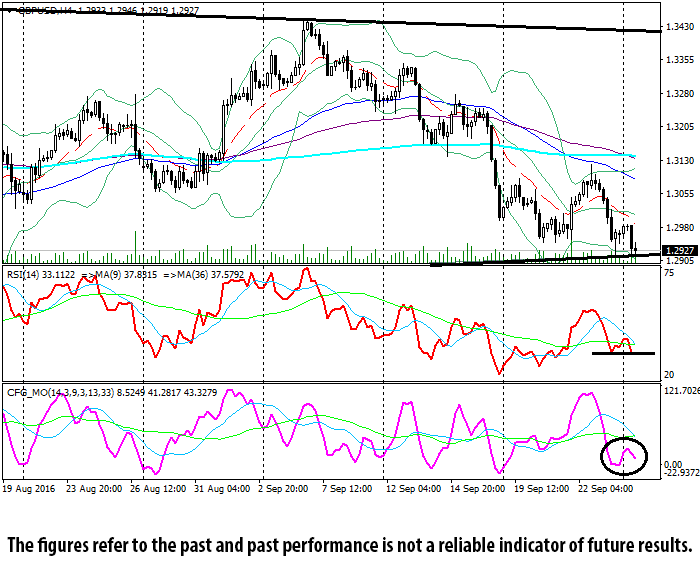

On the 4-hour chart, the pair is trading in the lower Bollinger band. The price remains below its moving averages that start turning down. The RSI is testing its most recent support. The composite is approaching its support level as well.

Support levels: 1.2915 (local lows), 1.2862 (August lows), 1.2796 (July lows).

Resistance levels: 1.3065 (local highs), 1.3360 (August highs), 1.3436 (September highs).