USD/CAD continues to fall inside the uniform Rising Wedge chart pattern, which was previously identified by Autochartist on the 4-hour chart. Autochartist measures the Quality of this chart pattern at the 7-bar level – which is the result of the above Initial Trend (5 bars), substantial Uniformity (8 bars) and significant Clarity (7 bars). Higher uniformity reflects the even distribution of the connecting points of this chart pattern. USD/CAD is expected to fall toward the lower support trendline of this Rising Wedge (standing near 1.3130).

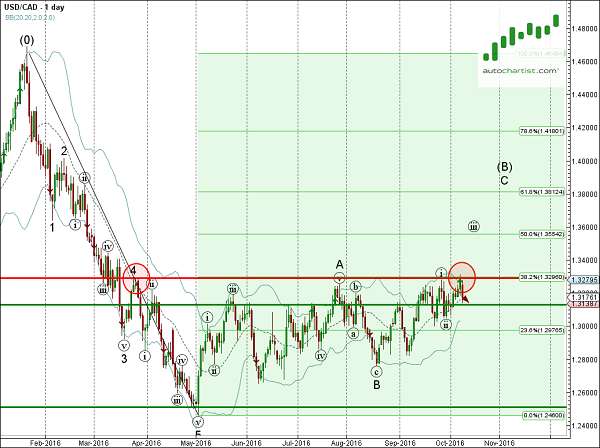

As you can see from the daily USD/CAD chart below, the top of this Rising Wedge formed when the pair reversed down from the resistance zone lying between the upper daily Bollinger® Band, major resistance level 1.3290 and 38.2% Fibonacci correction of the previous sharp downward impulse from January. The proximity of this resistance zone adds to the likelihood USD/CAD will continue to fall inside this Rising Wedge.