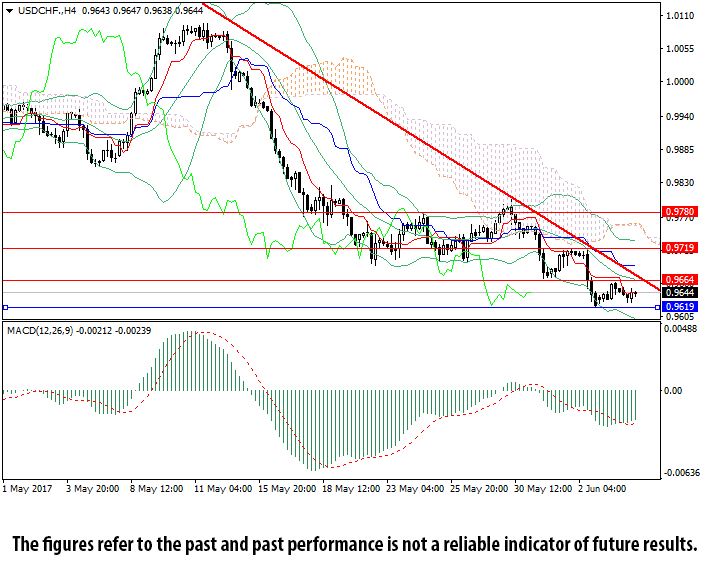

USD/CHF is still unable to move away from a long fall. Weak Friday statistics on the US labor market continues to put pressure on US dollar. The pair is trading around its 6-months minimums at 0.9620. After several attempts to test this mark the trading became less active, and the rate moved to side dynamics.

Today's calendar contains no important macroeconomic releases that may considerably influence the dynamics of USD/CHF rate. In this situation the participants of the market will continue to focus on weak US labor market data which in turn will lead to the continuation of the current dynamics.

Bollinger Bands are directed downwards indicating the preservation of the decreasing tendency. MACD histogram is in the negative zone but its volumes slightly decreased and are moving along the zero line indicating the lateral nature of market movement. If the sellers manage to consolidate below the support level of 0.9619, the fall will continue to 0.9571-0.9522. If the buyers take the initiative and increase the rate above the middle line of Bollinger Bands (0.9664), growth may continue to 0.9720.

Support levels: 0.9619, 0.9571, 0.9522.

Resistance levels: 0.9644, 0.9719, 0.9780.