Overnight saw another high volume, volatile session for forex, driven on the back of strong US economic data. However, it was impossible for currency traders to sidestep OPEC musings given a 4% drop in WTI, after the cacophony from headlines all pointing to the division between the Saudi agenda and the reality of Iran and Iraq’s position, with no commitments made from non-OPEC producers such as Russia.

The Australian Dollar

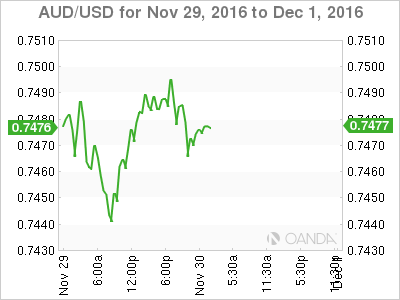

The Australian dollar has been resilient overnight in the face of a stronger USD and notable weakness in the key iron ore sector. After trading above the psychological US $80 per tonne level for the first time in 2 years, the industrial metal shed over 6% in response to China pulling punitive sanctions on its domestic coal industry.

While overnight the price of coal retreated, tempering a recent run in steel prices, I expect a shift in market sentiment may keep industrial metals well supported. An underlying growth element in the economy is being expressed in the industrial metals market, underpinning the AUD in spite of a possible rise in US interest rates. If US fiscal spend takes shape, there could be a massive shift in investor sentiment towards growth, rather than a fixation on yield.

On the data front, the big miss on Australia building approvals has seen the Aussie pull back from inter- morning highs near .7500. Given that the market is positioned long Aussie dollar we will likely see some profit taking which may pressure stop losses from weak long Aussie positions.

Japanese yen

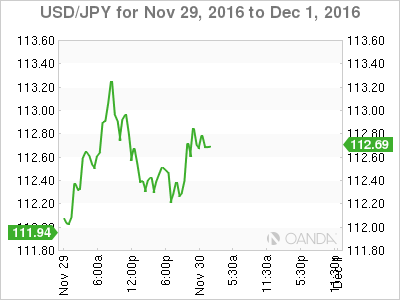

The price action overnight has been very constructive for dollar bull traders, despite an OPEC headline-induced pull back, strong trends continue to emerge. Supportive US economic data had traders tripping over one another reaching for top side exposure, propelling USD/JPY to 113.25 before the festoon of OPEC headlines spoiled the party.

I note two things from the recent market price action:

-

Shorting the USD in this current environment offers the same risk-return as betting against Real Madrid; while supporting the underdogs – it gives one a warm and fuzzy feeling, but it is not a splendid idea to let this bias become the basis of your bets. While there is still a significant element of dollar naysayers in the market, it is gradually becoming apparent that the greenback is currently the only game in town and best to pay close attention to the underlying trend

-

It is hard to tell what results will come from the OPEC meeting, but the evidence is that the OPEC club is certainly noisy when it comes to doing nothing

Finally, there will likely be some month end fidgets in the US dollar long trade as traders are beginning to adjust books for what has been rumoured to be large scale USD selling at the London 16:00 GMT Fix

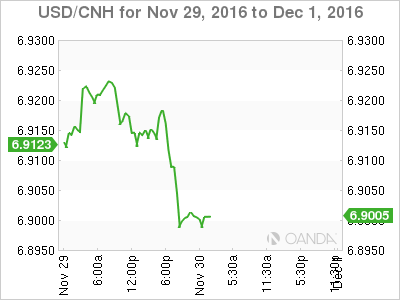

I remain unsure if there was state bank intervention on Monday, however, their presence was in full force yesterday, providing USD offers (liquidity) in the onshore spot markets in an attempt to stem the acceleration of capital outflows.

The speeding up of yuan weakness of late has spooked the PBOC. Since the US election, Mainlands appetite for all things US dollar has accelerated, as the population seeks out creative measures to get their money out of China and into the USD, their primary vehicle.

Year end USD demand is likely to accelerate and with the USD dollar bullish trend likely to remain in tack the PBOC may be doing little more than putting their finger in the dyke. One can only imagine a push through the psychological USD/CNH 7 barrier will only accelerate outflow.