Qinetiq's (LON:QQ) July AGM statement highlighted that conditions remain as at the full year results, demonstrating that the group continues to deliver sustainable cash-generative growth. CEO Steve Wadey’s strategy is to drive the core UK business, expand internationally and ensure continued innovation underpinned by a transformation programme to improve customer focus and competitiveness. With c £275m of cash on the balance sheet and further cash generation expected in FY17, the group’s capital allocation policy guides uses of cash to promote conditions for growth through increased capex and select bolt-on acquisitions.

FY results showed cash generation continues

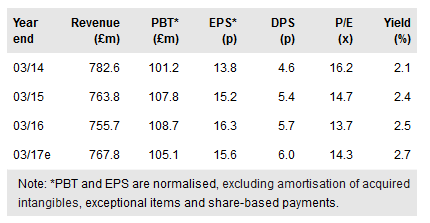

QinetiQ published positive FY16 results in May despite an uncertain environment, demonstrating once again the robust and cash-generative nature of the group. Revenues were down 1% organically at £755.7m, while underlying operating profit fell 2% to £108.9m. PBT increased by 1% benefiting from the reduced financing costs following early repayment of private placement debt in the prior year, while EPS increased by 7% to 16.3p as a result of the improved profitability, lower than forecast tax rate and reduced share count post buyback. Cash generation was again impressive at 96% post capex, with net cash growing further to £274.5m.

To read the entire report Please click on the pdf File Below