McDonald’s Corp. (N:MCD) Consumer Discretionary - Hotels, Restaurants & Leisure | Reports January 25, Before Markets Open

Key Takeaways

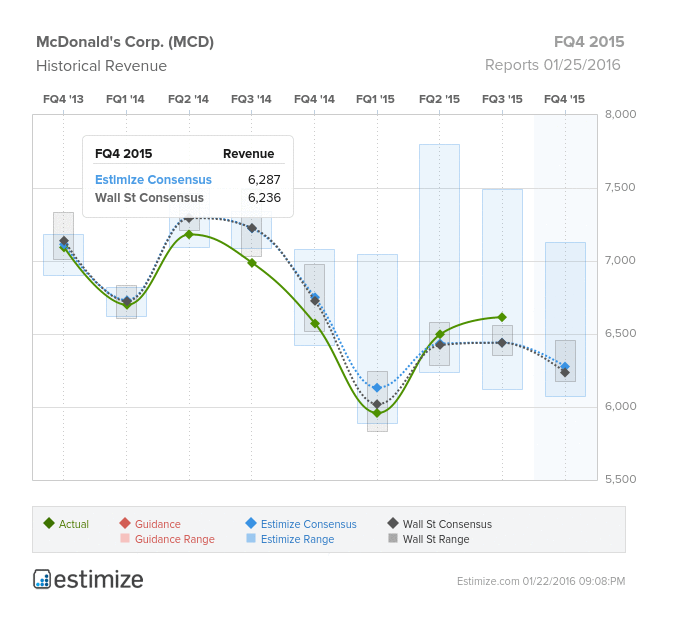

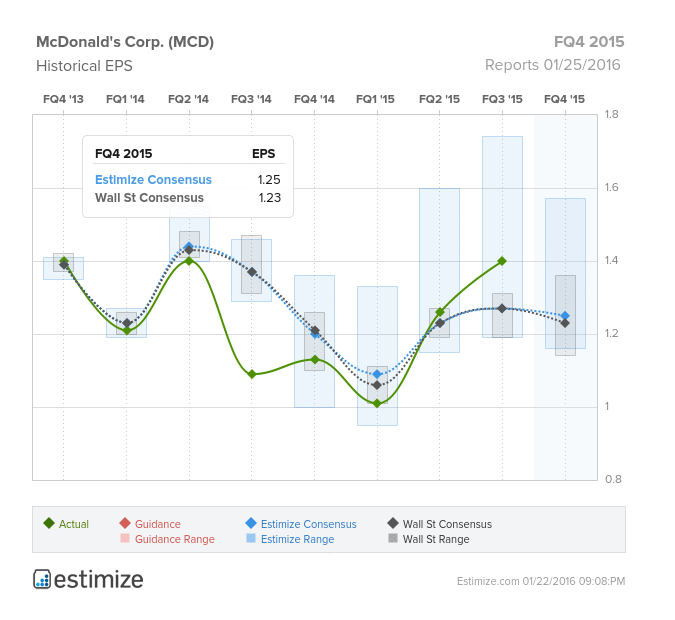

- The Estimize consensus calls for EPS of $1.25 and revenue of $6.287 billion, slightly higher than Wall Street’s estimates

- McDonald’s has restructured operations into 4 key segments based on needs, challenges and opportunities for growth

- The Golden Arches faces slowing growth in Asia due to low quality ingredients and currency headwinds

- What are you expecting for MCD?

Best known for the Golden Arches, McDonald’s (MCD) is set to report Q4 2015 earnings January 25th, before the markets open. Despite losing market share to the rapidly growing fast-casual sector, the fast food giant posted better than expected third quarter results. McDonald’s has likely been a beneficiary of the struggles Chipotle faces with multiple E. coli outbreaks. Meanwhile, the quick service restaurant is trying to reposition itself through new menu offerings, marketing strategies and global expansion. So far this has paid off as share prices rose 27% over 2015 with the company poised to close the fiscal year strong.In fact, the Estimize consensus calls for EPS of $1.25 and revenue of $6.287 billion, slightly higher than Wall Street’s estimates. Compared to Q4 2014, this represents a projected YoY increase in EPS of 11%. Despite having strong growth initiatives in place, currency headwinds, struggles in Asia and a shift to cage-free eggs poses a short term threat to McDonald’s revenue.

In mid 2015, McDonald’s restructured operations into 4 segments combining markets with similar needs, challenges and opportunities for growth. These include the United States,mature markets, higher growth markets and foundational markets. The United States, as you would suspect, is the company’s largest segment accounting for 40% of total revenue. To help stimulate growth in the U.S., McDonald’s has introduced new products, marketing initiatives and expanded its value menu. This includes all day breakfast, McCafe coffee and their most recent promotion the McPick 2 which has driven revenue growth. Given the rise in health conscientious Americans, McDonald’s has vowed to transition completely to cage-free eggs to meet consumer preferences for high quality ingredients. The mature markets, the second largest segment, include large European countries, Canada and Australia. McDonald’s has performed remarkably well in these markets, posting positive comparable sales as a result of the company’s focus on high quality and customer convenience. McDonald’s high growth segment has been a cause for concern over the past year. These include smaller European countries and Asian markets which large franchising potential. McDonald’s Japanese subsidiary has experienced deccelerated growth after a series of food contaminations and operational inefficiencies which they are hoping to rebound from with special menu items. Slowing global growth and currency headwinds add additional pressure on McDonald’s margins overseas. That being said, the Golden Arches maintains its strong brand recognition around the world and should continue its upbeat earnings trend.