EUR/USD

For the 24 hours to 23:00 GMT, EUR declined 0.12% against the USD and closed at 1.3820, after the ECB President, Mario Draghi stated that policymakers are closely monitoring the strength of the euro and that the central bank is ready to do “what is needed to maintain price stability”. Furthermore, he indicated that the ECB’s forward guidance could keep “policy interest rates as low as they are currently or even lower for an extended period of time” in the euro-zone economy. Negative sentiment for the euro was also fuelled after an ECB policymaker, Jozef Makuch stated that deflation risks in the euro-zone have risen in the recent times and that the central bank is prepared to take “additional non-standard measures to avoid getting into a deflationary environment.” Separately, an ECB Governing Council member, Jens Weidmann also hinted towards the possibility for the central bank to buy loans and other assets from banks to help support the economy while another ECB official, Erkki Liikanen suggested that the idea of negative interest rate should no longer be a controversial issue in the region.

The euro-bloc’s common currency declined further after the IFO index on Germany’s business climate and business expectations fell more-than-expected to a reading of 110.7 and 106.4, respectively, in March. However, Germany’s IFO current assessment index advanced more than estimates to a level of 115.2 in March, from previous month’s reading of 114.4.

The US dollar gained ground after data showed that consumer confidence in the world’s largest economy, the US, surpassed analysts’ expectations and rose to a six-year high reading of 82.3 in March. However, new home sales in the US fell more-than-expected and hit a five-month low reading in February.

Meanwhile, discussion surrounding the Fed Chief, Janet Yellen’s comments last week intensified after the Philadelphia Fed President, Charles Plosser stated that Janet Yellen’s comments on interest rate were not a “mistake” as some had speculated and the central bank has not yet changed its position in any way on interest rates. Additionally, the Chief of Atlanta Fed Dennis Lockhart, opined that the US Fed would take more than six months time from the end of its QE programme to hike its interest rate, which could probably happen in the second half of next year. Separately, the Dallas Fed President, Richard Fisher, stated that the central bank would keep its interest rates near zero until it is confident on the recovery of the US economy.

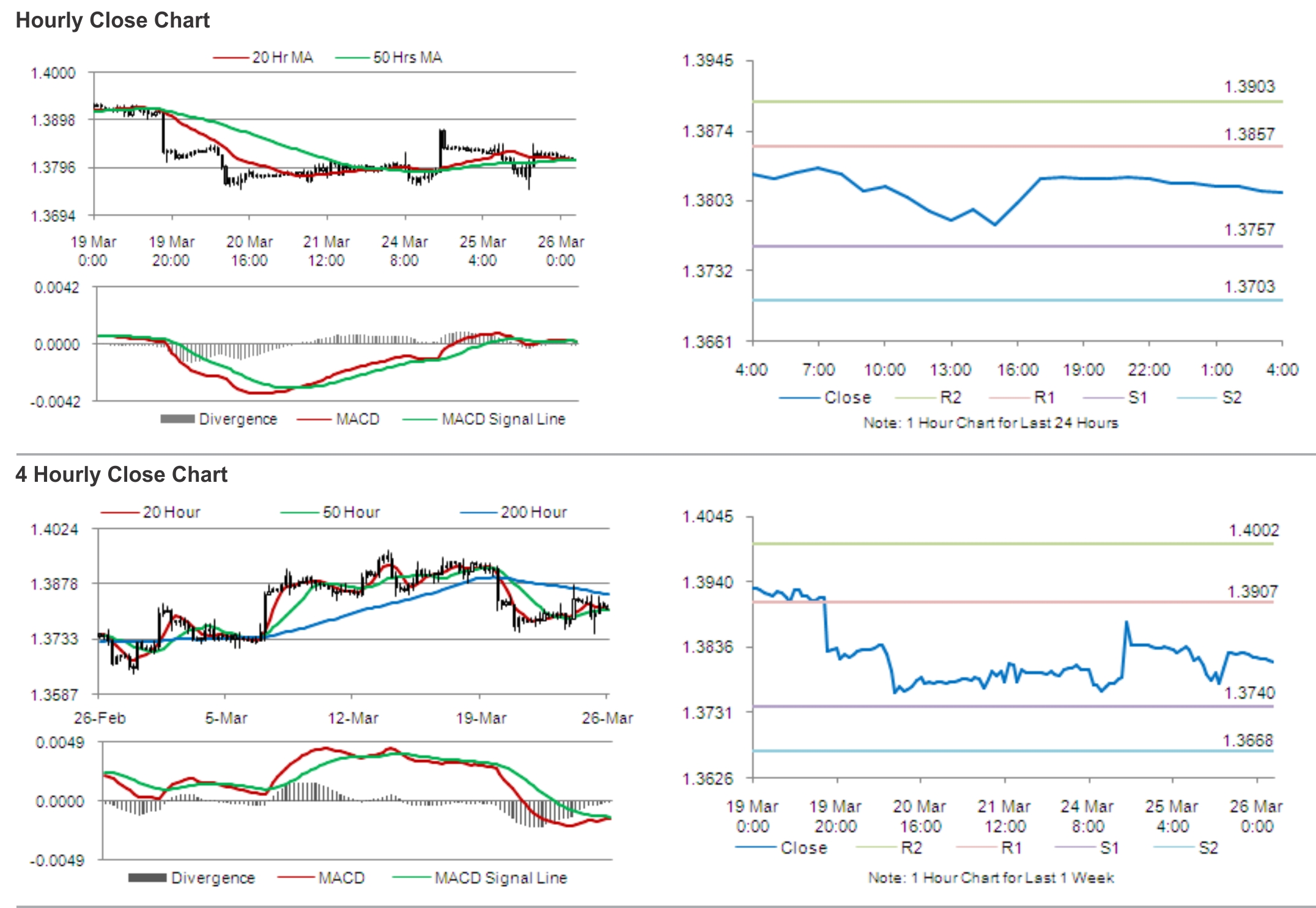

In the Asian session, at GMT0400, the pair is trading at 1.3812, with the EUR trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.3757, and a fall through could take it to the next support level of 1.3703. The pair is expected to find its first resistance at 1.3857, and a rise through could take it to the next resistance level of 1.3903.

Later today, traders would eye Germany’s Gfk consumer confidence data and Italy’s consumer confidence and retail sales data for further cues in the euro.