Key Highlights

· The Aussie dollar remains above a major support area at 0.7560 against the US dollar.

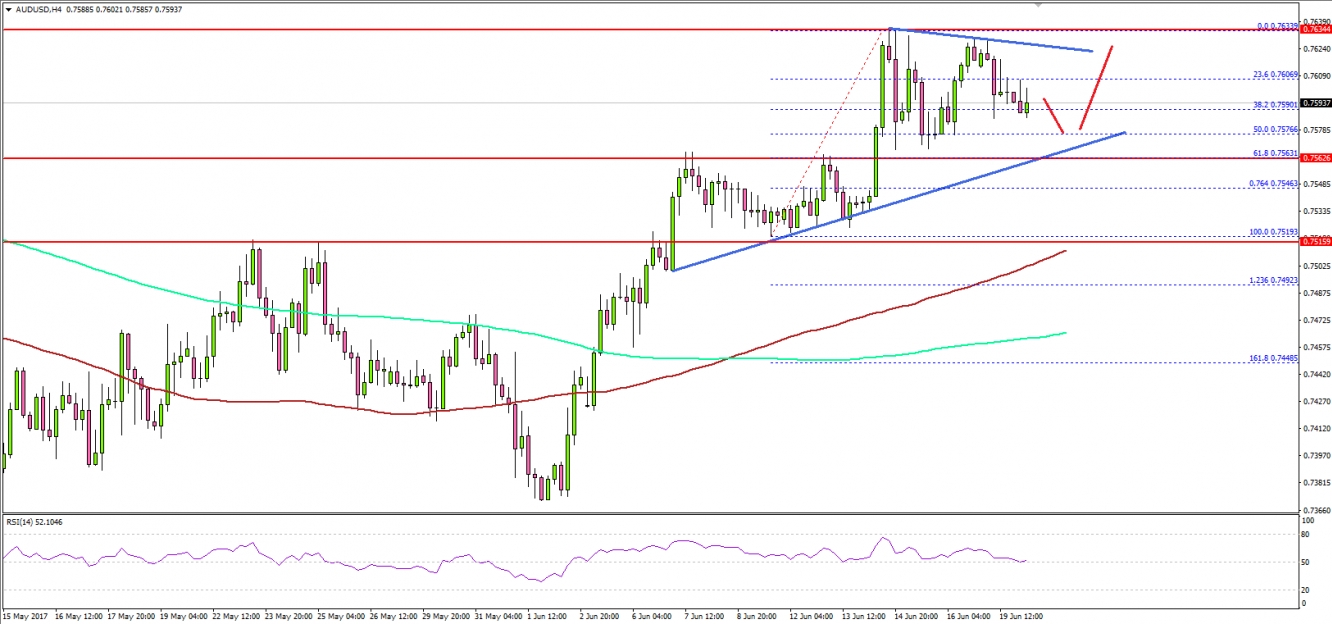

· There is an important bullish trend line forming with current support as 0.7565 on the 4-hours chart of AUD/USD.

· The minutes of the Reserve Bank of Australia meetings released today had no major negative impact on the Aussie dollar.

AUDUSD Technical Analysis

The Aussie dollar after consolidating this past week above 0.7520 gained momentum against the US dollar. The AUD/USD pair broke the 0.7560 resistance and now looks set for more gains.

The pair recently struggled to break the 0.7630-35 resistance and started a correction. There is an important bullish trend line forming with support as 0.7565 on the 4-hours chart.

Furthermore, the 50% Fib retracement level of the last wave from the 0.7519 low to 0.7633 high is also positioned at 0.7576 to provide support on dips.

It seems like the pair is well supported on the downside above 0.7560. As long as the pair holds the mentioned support, it can bounce back towards 0.7630 or higher, considering the fact that the 100 SMA (H4) is pointing further gains.