G-III Apparel Group, Ltd. (NASDAQ:GIII) was a big mover last session, as the company saw its shares rise over 15% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This reverses the recent trend for the company — as the stock is now down 4.1% in the past one-month time frame.

The upside seems to have been driven by the company’s just released first quarter fiscal 2018 results, which were better than expected.

The company has seen one positive estimate revision in the past few weeks, while its Zacks Consensus Estimate for the current quarter has also moved higher over the past one month, suggesting that more solid trading could be ahead for G-III Apparel. So make sure to keep an eye on this stock going forward to see if this recent jump can turn into more strength down the road.

G-III Apparel currently has a Zacks Rank #4 (Sell) while its Earnings ESP is positive.

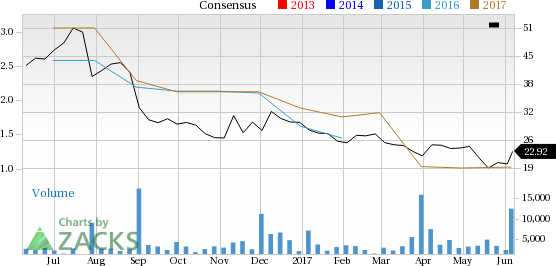

G-III Apparel Group, LTD. Price and Consensus

A better-ranked stock in the Textile - Apparelindustry is Cherokee Inc. (CHKE), which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is GIII going up? Or down? Predict to see what others think: Up or Down

3 Stocks to Ride a 588% Revenue Explosion

At Zacks, we're mostly focused on short-term profit cycles, but the hottest of all technology mega-trends is starting to take hold...

By last year, it was already generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. See Zacks' Top 3 Stocks to Ride This Space >>

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post

Zacks Investment Research