By a slim margin, the Turkish people voted to change the country’s government from a Parliamentary system to a Presidential one. The change will reportedly cement the power of President Recep Tayyip Erdogan and allow him to stay in power for as long as 2029 assuming he wins the next two Presidential races. Erdogan argued this change will modernize Turkey’s democracy and address its security challenges.

Opponents decry a steady march to authoritarian rule. From my outsider perspective, both sides have convincing arguments. However, I think that allowing such dramatic changes to governance to pass on just 51% of the vote seems like a recipe for future political instability. On that basis alone, the Turkish lira becomes incrementally less attractive for (long-term) speculation. It also seems clear that the vote will prevent Turkey from joining the European Union (EU) – a prospect that Erdogan defiantly declared no longer matters for his country.

Christian Amanpour from CNN conducted excellent interviews from both sides. She interviewed Erdogan’s spokeswoman Gulnur Aybet and then the chair of the German Parliament’s foreign affairs who was very vocal in his critique of the election by declaring that the EU should “formally suspend” membership talks.

The two sides left me undecided for the immediate prospects for the Turkish lira. Apparently, the market feels the same way.

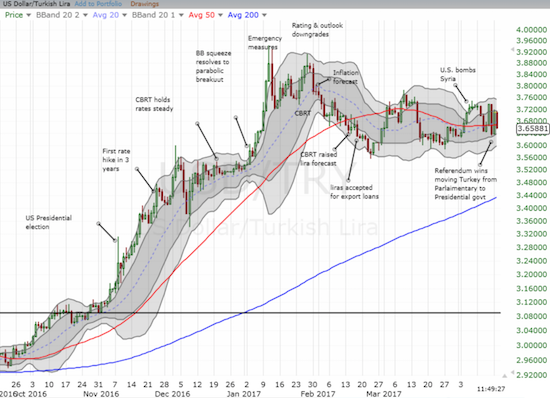

The Turkish lira weakened sharply going into the election and then strengthened sharply in the immediate wake of the Sunday results. Monday and Tuesday have delivered similarly sharp gyrations up and down.

The Turkish lira versus the U.S. dollar, USD/TRY, has bounced in a well-defined range since falling from a test of its all-time high in late January.

EUR/TRY has recently traded in a wider range than USD/TRY

At the time of the election results I just happened to be short EUR/TRY as part of my speculation that the Turkish lira could be the next emerging market currency to go on a contrarian bull run. I decided to take the profits from the position and have switched to trying to play the current volatility.

I am currently long USD/TRY. Ultimately, the bigger trade will follow the lira’s move above or below the current extended consolidation period. Such a definitive move may need to wait for the uptrending 200DMA to run into the consolidation period.

Be careful out there!

Full disclosure: long USD/TRY